April is National Financial Literacy Month

We love the national focus on financial literacy because it reinforces our belief that education is fundamental to the financial security of those we serve.

To help you achieve your financial goals, consider these resources that promote financial literacy in April and all year long. You’ll find a wealth of knowledge for your personal financial plans as well as financial literacy resources for your classroom.

Money Management International’s 30 Steps to Financial Wellness

April is officially Financial Literacy Month, but you can pledge to take these 30 steps any time you’re ready! The 30 steps are designed to help you identify your money weaknesses and turn them into strengths.

Retirement Toolkit

The Employee Benefits Security Administration offers a list of publications, videos, and interactive tools to help in your retirement planning.

FDIC – Money Smart

A financial education program can help people of all ages enhance their financial skills and create positive banking relationships.

MyMoney.gov

MyMoney.gov provides information about and links to a collection of federal guides and curricula for teaching financial capability concepts.

Jump$tart Coalition for Personal Financial Literacy

A national non-profit coalition of organizations dedicated to improving the financial literacy of pre-kindergarten through college-age youth. Download free national standards, comprehensive content based financial education, a database of resources, and more. Click here for Wisconsin’s Jump$tart page.

Edutopia: Resources and Downloads for Financial Literacy

A comprehensive list of links to resources to help students learn financial concepts, practice money management, and build strong financial decision-making and economic-reasoning skills.

AnnualCreditReport.com

The official site to get your free annual credit reports. Credit reports play an important role in your financial life and its a good idea to regularly check your credit history.

Don’t forget to set up your personal financial consultation

Make an appointment for a financial planning service* with Member Benefits. Or call 1-800-279-4030. Summer appointments fill up fast.

*These products and services are offered to Wisconsin residents. All investment advisory services are offered through WEA Financial Advisors, Inc. Consultation is free; however, if you choose to invest in the WEA Tax Sheltered Annuity or WEAC IRA program, fees will apply. Consider all expenses before investing. Must meet eligibility rules to participate. Family members may also be eligible. Call for details.

Saving by the decade – Finish strong

Building that nest egg for your daily needs can be a challenge. And for many, the idea of saving for retirement is often a ‘tomorrow’ idea—until it becomes ‘soon.’ But the longer you wait to save, the more it can cost you. We share some general guidelines to make saving a bit easier by the decade.

Your 60s: Finish strong

This is a time to set yourself up to enjoy retirement. According to Social Security’s life expectancy calculator, the average age someone age 65 can expect to live to is 84.2 for males and 86.8 for females. However, one out of three males and one out of two females who are in their mid-50s today will live to age 90 (Society of Actuaries Age Wise Longevity Infographic Series, 2019). So you need to plan for at least two decades of retirement, perhaps even longer.

Financially, it’s time to decide on when to take Social Security and to make your final decisions regarding WRS. Your estate plans, life insurance, health insurance, and long-term care insurance policies should all be in order.

In this decade (or before), you may be visited by other companies regarding your retirement accounts. Be sure you understand all costs involved, including advisory fees or annuities you may be locked into before you make a decision to move your money.

If you’ve had several jobs, may want to consider consolidating accounts with Member Benefits to minimize costs. Our financial advisors can help you evaluate retirement plans, help you shift your risk, or do a comprehensive Retirement Income Analysis to define your retirement goals, evaluate your financial position today, and determine whether you are on track to meet your goals and create a withdrawal strategy.

You’ll also want to understand and plan ahead for the annual RMD you have to start taking out of your retirement account once you reach RMD age (unless it’s a Roth IRA).

Member Benefits can help turn your retirement savings account balance into income during retirement with yourINCOME PATH, a suite of solutions and support we offer that includes a range of flexible withdrawal options to meet cash flow needs, RMD support, qualified charitable distributions, Roth conversion strategies, and more. There are no additional costs for this service if you have an account with us.

Revisit your plan often

None of our suggestions need to be limited to a specific decade of your life—many of them apply to other decades and across your career. Of course, depending on what age you are now, things may change quite a bit by the time you reach future decades. Be ready to tweak your plan, keep yourself informed over time, and visit your plan often.

If you weren’t able to start saving in early in life, remember—no matter what decade you’re living in, it’s never too late to start.

<<Part 4, Catch up

>>Return to Part 1 of our series on saving in your 20s.

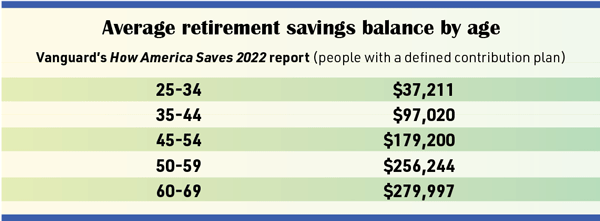

Sources: Citizens First Bank, Forbes, Vanguard.

Your actual situation may be different depending on future rates. No guarantees are expressed or implied. If you choose to invest in the 403(b) or IRA programs, fees will apply. Consider all expenses before investing. Mutual fund management and redemption fees may apply.

Saving by the decade – Catch-up if needed

Building that nest egg for your daily needs can be a challenge. And for many, the idea of saving for retirement is often a ‘tomorrow’ idea—until it becomes ‘soon.’ But the longer you wait to save, the more it can cost you. We share some general guidelines to make saving a bit easier by the decade.

Your 50s: Catch-up if needed

For many people, this tends to be a good earnings decade, so take advantage of it. Now is the time to figure out what you may be missing and catch up if you’re behind. Both the 403(b) and the IRA allow an age 50 and over catch-up option (learn about contribution limits). Some districts may also offer a 15 years of service catch-up provision in their 403(b) plan. Contact your district office to learn more.

If you can accomplish it, your debt should be paid off except for a mortgage and potentially your cars. Keep up your emergency savings to equal three to six months of salary.

It may be hard to hear, but you also qualify for some senior discounts in this decade—why not embrace them?

If you don’t have a life insurance policy yet, now is a good time. You may also want to consider long-term care insurance. Most costs for extended care needed during recuperation from strokes, accidents, illnesses, and operations are not covered by health insurance or Medicare. And it may be less expensive to start a policy while you are relatively young. Associates of Clifton Park is our long-term care partner and can tailor a policy to cover many circumstances.

Now is also a good time to start learning about your benefits with the Wisconsin Retirement System (WRS), Social Security, and Medicare. Download our free 20 WRS FAQs eBook to get started.

As you get closer to retirement, you may want to start considering where you might live and what you will do for work, personal insurance, and health insurance. Our financial planning advice options can help you evaluate your current investment portfolio or explore whether you’re on track for retirement. And if you are close to retirement, our financial planners can help you define your retirement goals, evaluate your financial position, and create a plan to turn your retirement savings into income during retirement.

<<Read Part 3 of our series on saving in your 40s.

>>Read Part 5 of our series on saving in your 60s.

Sources: Citizens First Bank, Forbes, Vanguard.

Your actual situation may be different depending on future rates. No guarantees are expressed or implied. If you choose to invest in the 403(b) or IRA programs, fees will apply. Consider all expenses before investing. Mutual fund management and redemption fees may apply.

Saving by the decade – Stay on track

Building that nest egg for your daily needs can be a challenge. And for many, the idea of saving for retirement is often a ‘tomorrow’ idea—until it becomes ‘soon.’ But the longer you wait to save, the more it can cost you. We share some general guidelines to make saving a bit easier by the decade.

Your 40s: Stay on track

Continue to pay down debt. If there have been any changes in your life, be sure to review your life insurance policies and check the beneficiaries on all of your policies and accounts.

If you haven’t done it yet, it’s a good idea to get your estate plan in order to make things easier on your family.

You may be able to add a flexible spending account (FSA) or health savings account (HSA) from your employer to your savings mix to help you pay for qualified medical expenses.

Make an inventory of your possessions to be well-prepared in the case of a serious insurance claim. You can take video or photos, or download our free Personal Property Home Inventory eBook.

However you save for retirement, be sure you know the underlying costs involved. Program costs vary between providers and impact your savings over time. Keep your money in your account working for you rather than being consumed by product or advisor costs. Learn more about fees in your retirement account.

Explore our financial coaching options at to learn more about fees, start some initial estate planning, make sure your savings plan aligns with your goals, and more.

If you have a 403(b) account with WEA Member Benefits, we offer you an interactive wealth management tool called eMoney at no additional cost. This tool also helps our financial planning staff provide you with the best strategic advice available. Visit eMoney to fill out an interest form.

<<Read Part 2 of our series on saving in your 30s.

>>Read Part 4 of our series on saving in your 50s.

Sources: Citizens First Bank, Forbes, Vanguard.

Your actual situation may be different depending on future rates. No guarantees are expressed or implied. If you choose to invest in the 403(b) or IRA programs, fees will apply. Consider all expenses before investing. Mutual fund management and redemption fees may apply.

Saving by the decade – Increase your savings

Building that nest egg for your daily needs can be a challenge. And for many, the idea of saving for retirement is often a ‘tomorrow’ idea—until it becomes ‘soon.’ But the longer you wait to save, the more it can cost you. We share some general guidelines to make saving a bit easier by the decade.

Your 30s: Increase your savings

During these years, you may want to save up for a home. You should also continue to build your emergency fund and tackle student loans and debt.

If you’re starting a family, you’ll want to make sure they’re properly protected by reviewing your personal insurance policies to ensure they have the appropriate coverage to protect your family and belongings. Consider adding umbrella insurance and life insurance in the mix.

Life insurance is an important part of your family’s financial stability and well-being. If anyone depends on your income, they would likely struggle if you were to pass away. It’s a simple answer to a very difficult question: How will my loved ones manage financially if something were to happen to me? Member Benefits offers a variety of life insurance options through our partner, Associates of Clifton Park. You can get a comparison quote online without providing any personal information.

If your budget allows, consider saving for your children’s academic future with a 529 college savings plan such as Wisconsin’s EdVest plan. These plans provide certain tax advantages, and grandparents and friends can contribute, too!

As a younger person, time is on your side in terms of the market and your future ability to generate income. While it can be a challenge to balance out family expenses, you should still put aside as much as you can towards your retirement. You may want to increase your after-tax options by adding a Roth IRA account to your savings plan, which has more investment options and no required minimum distributions (RMD) during your lifetime. A Roth IRA also has more flexibility with respect to accessing your money prior to retirement.

Member Benefits can help you make educated financial decisions based on your situation, investment objectives, and risk tolerance. Use our Investor Suitability Profile Questionnaire to help you determine what kind of investor you are.

You may want to consider scheduling a financial planning consultation to discuss budgeting, saving, or a net worth analysis. Learn more about our financial coaching options.

<<Read Part 1 of our series on saving in your 20s.

>>Read Part 3 of our series on saving in your 40s.

Sources: Citizens First Bank, Forbes, Vanguard.

Your actual situation may be different depending on future rates. No guarantees are expressed or implied. If you choose to invest in the 403(b) or IRA programs, fees will apply. Consider all expenses before investing. Mutual fund management and redemption fees may apply.

Saving by the decade – Get started

Building that nest egg for your daily needs can be a challenge. And for many, the idea of saving for retirement is often a ‘tomorrow’ idea—until it becomes ‘soon.’ But the longer you wait to save, the more it can cost you. We share some general guidelines to make saving a bit easier by the decade.

Saving money…it’s more than just spending less so you can build up your bank account. Saving more for your daily living needs and to meet your financial goals includes managing your budget, eliminating debt, strategizing your investments, protecting your assets, and more.

And just as importantly, it also includes preparing for your retirement—even if that seems like a long time from now. Not enough of us are doing so. According to the U.S. Census 2021 Survey of Income and Program Participation, among working-age individuals (ages 15 to 64), only 47.8% of men and 43.5% of women owned a retirement account—meaning over half do not have a retirement account at all. Baby Boomers (ages 56-64) were the most likely to own at least one type of retirement account, while Gen Z members (ages 15-23) were least likely to own a retirement account…but to their advantage, if they choose to use it, they also have the most time to accumulate additional retirement savings.

How you spend, save, and invest in every decade of your life has a significant impact on your financial well-being and financial future. Consider these tips to help manage your finances at every age and work toward a more secure retirement.

Your 20s: Get started

This is often the decade where you’ll make the least money—but it’s a great time to start building a budget, establishing your credit, and bulking up your emergency fund. Use our free budget form to help you start some good financial habits.

Contribute as much as you can to a 403(b). Your district may offer an employer match where the district matches your contributions—it could be fifty cents on the dollar up to a certain level, a flat amount, or many other types of options. As an added bonus, a match effectively increases your income without increasing your tax bill, since you pay no taxes on matching contributions until you withdraw them in retirement. If you’re not putting money into your 403(b) and there’s a match, then you may be leaving money on the table. Make it a goal to at least meet the match your district offers, if available. If you can afford to save more, even better!

Saving for your future now, even if it’s not a lot, gives you ample time to capitalize on the power of compound interest. The benefit of compound interest is that it grows over the years, earning interest on interest on interest. Even small contributions now can make a significant difference in your future nest egg.

>>Read Part 2 of our series on saving in your 30s.

Sources: Citizens First Bank, Forbes, Vanguard.

Your actual situation may be different depending on future rates. No guarantees are expressed or implied. If you choose to invest in the 403(b) or IRA programs, fees will apply. Consider all expenses before investing. Mutual fund management and redemption fees may apply.

The beauty of budgeting

Having a budget is a key component of any financial plan. You can’t have a plan without having a clear understanding of what money is coming in as well as what is going out—and where it’s going.

When people feel overwhelmed by financial issues and unsure of what to do, a budget is the place to start. It requires an investment of time up front and it requires you to face the good and the bad of your financial situation. But the pay off and benefits are long-lasting.

Writing a budget helps you set and achieve goals by:

- Setting priorities.

- Keeping you from spending more than you earn.

- Giving you permission to spend.

- Giving you a plan to eliminate debt.

- Helping you save money for long- and short-term needs.

- Preparing you for financial emergencies.

Developing a budget can be a empowering experience that can help you take control of your finances. Explore our helpful tools and resources in the article sidebar to get started on your own budget strategy.

Planning for the effects of inflation in your retirement plan

In 2021, inflation increased by 7%—its highest point since 1982 (Bureau of Labor Statistics). So $1 at the beginning of last year was worth around $0.93 at the end.

While inflation is an important consideration, it’s just one of several risks you need to manage in retirement. Protecting yourself in retirement consists of:

- Creating an income plan that factors in inflation over the course of many years.

- Adjusting for inflation spikes that may affect your short-term budget.

While it’s not time to panic, you shouldn’t ignore it, either.

Here are a few steps to consider to help protect your savings.

Save where you can. Even modest steps can add up. Being flexible about your travel or where you live can also help.

Continue investing. Consider keeping some of your savings in stocks for long-term growth.

Pay off debt. Eliminating debt should be a top priority in retirement.

Consider working. Every dollar you earn in retirement is a dollar you don’t have to withdraw. Go part-time or explore a second career as a buffer. It may be an interesting opportunity you hadn’t considered.

If this has you feeling a bit anxious, keep this in mind: Having WRS as a public school employee is a great advantage for you, along with Social Security’s built-in cost of living increases and your personal retirement savings.

Need some guidance?

Explore our financial planning options. Our expanded services give you even more choices to meet your individual needs. We’re here to help.

The above content is not a recommendation to invest. Please consult your financial planner to determine the path best for your financial well-being.

Sources: Kiplinger, Forbes Advisor.

Sarah’s garden of financial knowledge

Sarah Campbell has been sowing seeds since 2009. She has watched those seeds sprout, grow, and in some cases, produce. The seeds Sarah sows are the seeds of financial literacy.

Her passion for financial literacy sprouted in her second year of teaching when she made discoveries about how to cultivate enthusiasm for this important topic in her students. She struggled her first year, teaching content straight out of the textbook. “The kids didn’t care,” she told us.

But after taking courses at the National Institute for Financial and Economic Literacy during summer break, everything changed. The experience showed her how to engage students by making the information personal and real.

Over the last 13 years her methods have changed—going deeper and broader—to reflect the needs of students and to keep up with advancements in technology and the financial world. But she is still teaching Personal Finance at Wisconsin Dells High School (WDHS) with great determination, and her responsibilities have grown, giving her more opportunities to promote financial literacy. But what does financial literacy mean?

Digging deep

For Sarah, it’s not enough to simply understand financial concepts and best practices. It’s much bigger than that. Being financially literate, she says, is about looking at your financial life from many angles—like how you fit into the economy, understanding your role in managing your finances, what your decisions mean to you and those around you, and taking a hard look at what you want your life to be and understanding how finances play into your ability to achieve goals. Sarah likes the term financial independence—it plays like a drum beat in her classes. “It’s the ultimate goal. Regardless of how financially literate you are, the end game is financial independence.”

But Sarah digs deeper still, helping her students look inward at their financial beliefs and why they hold those beliefs. “Understanding the financial mindset that drives decisions, even those that don’t seem financial at the time, can be really useful and necessary.”

If it sounds a little philosophic, that’s because it is. Taking responsibility for your own financial position has been her emphasis from the start, telling students to ‘own’ their future. Her message was and still is, “It’s up to you to determine what you want your life to be like and how you are going to make it happen. No one else can do that for you.”

To incorporate her philosophy in the classroom, Sarah created characters they follow through the units. “I give them a variety of back stories and future plans to reflect the diversity in my class. We analyze their situations, create solutions, discuss back-up plans, and plot out future plans for them.”

And she says a change in scheduling has played to her advantage. Back in 2009, Sarah’s personal finance class lasted nine weeks. Not a lot of time to cover so much ground. That changed to 18 weeks after the district moved away from a block schedule. “I still have around 65 hours, but now it’s spread out into shorter chunks. For me, it’s a win. The longer time frame allows for more time for students to process the information and practice self-observation, and I have more time to build trusting relationships,” she explains.

“Understanding the financial mindset that drives decisions, even those that don’t seem financial at the time, can be really useful and necessary.”

Born to sow

“Without a doubt, imparting financial knowledge is what drives me in the classroom, and not just in the Personal Finance course. I incorporate a lot of financial literacy into my other classes AND my academic support period.” Her additional responsibilities give her plenty of opportunities. She serves as the MATC Dual-Credit Instructor for Accounting and Microsoft Office. Dual-credit courses, she explains, allow eligible students to complete their high school graduation requirements while earning college credits at no cost to the student. “But becoming the Youth Apprenticeship Coordinator was the biggest change to my duties. This program integrates school-based and work-based learning to instruct students in employability and occupational skills.” In essence, students get to “try on” possible career paths without the expense of post-high school courses. Sarah sees it as a time of discovery with very real financial implications.

“I had a student work for two years as an auto mechanic, and during his last semester realized he wasn’t happy. He was relieved that he didn’t waste two years of time and money after high school only to learn it wasn’t for him. Another student, interested in business, was able to complete an accounting program at MATC in a year and a half and begin working. It saved him both time and money,” she adds.

WDHS gives students a head start

Wisconsin Dells is one of just 800 school districts in the nation where a one-semester personal finance course is required for graduation. Currently, just one in six students across the nation graduate with a decent financial literacy education, and only 10 states guarantee at least a one semester course in personal finance before graduation. Wisconsin is not among them—leaving it up to the district to decide if and how they want to do it.

“High school is really the best time to get it into their head,” Sarah explains, “while they are on the cusp of major decisions that could determine the trajectory of their lives.”

Data supports Sarah’s hypothesis. Studies show that graduates of high schools with guaranteed financial education are 21% less likely to carry a balance on a credit card while in college1 and are less likely to fall prey to high-cost predatory loans (such as payday loans) than their peers without guaranteed financial education.2

Statistics like these, financial literacy advocates say, show that providing financial education offers a great return on investment.

“Regardless of how financially literate you are, the end game is financial independence.”

Reaping the harvest

Sarah also has a lot of personal examples where the seeds she sows yield good results.

“Just last summer a student stopped by on her way to college, literally packed up in her new (used) vehicle purchase. She was excited to tell me that although the dealer encouraged her to take a six-year loan to reduce monthly payments as a college student, she was adamant on a four-year loan because she did NOT want to have the loan follow her after college. She was so proud of herself,” Sarah shares.

Another time, she saw a student at a baseball game. “Always the jokester—he told me he bought a brand-new truck and stretched out the loan to seven years! But then he began laughing and said, ‘just kidding, I knew better than that.’ In reality, he purchased a used truck for a price that fit into his budget with a four-year loan.” Then his friend jumped in. “He said he got his first credit card and likes to max it out, then make only the minimum payments when he remembers. He broke out laughing too, and assured me he only uses it for gas and pays it off every month. They knew these things were the exact opposite of what I taught them and they didn’t want to disappoint me. Not only did they apply the concepts to make responsible choices, but they wanted me to know it, too. And, they enjoyed hassling me a little,” Sarah chuckles.

In her own backyard

Sarah’s ultimate goal of financial independence for her students is also something she strives for personally and teaches in her home.

In 2009, when her daughter was just three years old, Sarah was intentional about financial literacy—using real life experiences as teaching moments such as the act of using cash in the grocery store to demonstrate the value of money in a transaction. And the financial lessons continued over the last 12 years.

“Because it has always been just the two of us, we have a lot of discussions about opportunity cost—not necessarily using economic terms, but instead ideas. ‘If we did this, got this, spent this—then what would we be willing to give up.’”

When her daughter turned 15 last spring, she started her first part-time job at a local greenhouse. “She loves getting her email alert on paydays. She examines the hours, the taxes, and the amount sent to her savings account. She’s had a savings account for a long time, but now she can see how her actions affect the balance.”

Her daughter has also dabbled in buying stocks with the help of her uncle. “They decided on an amount to invest five or six years ago. She looked for businesses she believed in and purchased a handful of shares in several. She watches them and has seen the ups and downs in performance.”

Sarah’s perennial practice

As for Sarah, she continues to practice what she preaches “maybe to a fault,” she admits. “Sometimes I am a little too frugal. I do love a good garage sale!” Giving herself permission to splurge sometimes is maybe her greatest financial challenge. “I probably could loosen up and enjoy some spending, but my mindset has always been focused on the financial security side of life.”

Sarah set her path when she was a teenager, taking some of her earnings from summer jobs to open an IRA. Then, she opened a 403(b) when she started teaching and has continued to invest and increase her contributions over the years. Saving is second nature for her. “I feel a great sense of security when I open my statements, knowing that the money is growing and will eventually meet me when I need it.”

Her parents, who retired shortly after the 2009 interview after a combined 78 years of teaching, inspire her. “It is encouraging to see them enjoy a comfortable retirement because of their commitment to saving and investing for their future. It motivates me to stay on track.”

Sarah points to the purchase of her home as the most important financial decision she has made since we last talked. “I was able to buy a home in the neighborhood where I grew up. I’m proud that I managed a 15-year mortgage so it will be paid off in five more years.”

Looking to future seasons

This hard-line approach isn’t for everyone but it works for Sarah. As for her future? She will continue to sow financial literacy seeds at WDHS in and out of the classroom. “I want to grow the Youth Apprenticeship program to reach more students and allow for more opportunities in all career paths,” she says. This school year she doubled enrollment in the program and looks to continue that trend.

“Personally, the next big step for me will be helping my daughter take her next steps in education.” The contributions Sarah has been making to her 529 college savings plan will help with the cost, but you can be sure her daughter will be involved in the financial aspects of her higher education. It’s just how Sarah helps good things grow.

We’re here for you

Learn more about Member Benefits’ programs and services by calling 1-800-279-4030.

1 Stoddard, C. and Urban, C. (2018). The Effects of K-12 Financial Education Mandates on Student Postsecondary Education Outcomes.

2 Harvey, M. (2019) Impact of Financial Education Mandates on Younger Consumers’ Use of Alternative Financial Services. The Journal of Consumer Affairs.

Before you head back to school…

Here are a few things to consider for your financial checklist before you head back to the classroom this fall.

Are you contributing as much as you can toward your retirement? Consider how much you can afford to save in your 403(b) and/or IRA. Also be sure to check on contribution limits.

Complete a new Salary Reduction Agreement (SRA) to give yourself a raise in your 403(b) contribution for the next school year.

Review beneficiaries. If you’ve experienced any life events (marriage, divorce, birth of a child, etc.) it’s time to update your beneficiaries. Beneficiaries named on your retirement account supersede your will.

Update your address, review your portfolio, and change your investment allocation. Visit yourMONEY online to review your account or make an appointment to meet with one of our financial advisors for more assistance.

Have you reviewed your home and auto insurance coverage lately? Get an insurance consultation or fill out a quote form.

Let your family know about the Member Benefits programs that are available to them.

This summer, and anytime, call us at 1-800-279-4030, Extension 8577 for assistance.