Mixing love and money

Many people in committed relationships sometimes underestimate the impact financial decisions can have on their partnership, their family, and their financial future. In fact, most couples don’t discuss their finances on a regular basis, which can lead to personal misunderstandings and resentments. Further, it can prevent people from making informed choices about their finances.

Communication is the key to making good financial decisions that will benefit you both in the long run. When people’s feelings and concerns are heard, it’s easier to move forward with a concrete plan.

Failure to communicate about finances can contribute to most of the relationship conflict between couples.

If you’ve been avoiding the money issue in your relationship, here’s why you should make the move to start a financial conversation with your partner.

Common cause of conflict

Time, plus social and economic changes, have affected how we define “family,” which can get complicated. We’re contributing more financial baggage than ever to our relationships, including credit card debt, student loans, mortgages, and other investments. This can make things seem overwhelming and hamper the financial conversation.

But even if your baggage is light, the money issue often weighs heavy. A 2025 Harris poll found that 85% of Americans are worried about money. Nearly half (46%) are losing sleep over money worries.

Also in 2025, a Talker Research survey found:

- One in three Americans are uncomfortable discussing finances in their relationship. Of those, almost half (44%) worried that discussing finances in their relationship will lead to disagreements. In fact, the average couple has 58 money related arguments per year.

- One-third (32%) of respondents stated they have different ideas from their partner on how much to spend and save.

- Four in five (82%) Americans surveyed believe couples having a similar philosophy about money is key for a healthy relationship. However, only 69% said they have a similar financial philosophy to their partner.

- Arguments were most likely about differing opinions of “needs” vs. “wants.”

Failure to communicate about finances can contribute to most of the relationship conflict between couples.

The meaning of money

Money doesn’t have meaning; we assign meaning to money. Our personal relationship with it is forged early in life. Childhood experiences, education, how our parents handled finances, and our financial and social status influence our views about it.

That means two people often come into a relationship with different ideas about what money represents and how it should be used. What defines a “good” financial decision depends on a person’s unique values and viewpoint.

Start a conversation

If we don’t have serious conversations about money, we won’t understand each other’s perspectives on the topic. And that’s an important first step to take before you can make a plan.

Open, honest communication is just as important with finances as any other partnership decision, whether it’s buying a house, changing jobs, or having children. If you’re not talking finances and feel stressed about it, you may find that once you acknowledge the obvious, it won’t seem so overwhelming. Being open, honest, and clear about monetary expectations may help prevent small issues from turning into big resentments.

Use the questions in the Financial conversation starters document to help you start a conversation, then…

Make a plan

- Decide who should handle the finances.

- Determine whether you will have separate or joint accounts.

- Work out who will pay what and how much. Make sure both of you are happy with the plan.

- Develop a strategy to balance saving against spending.

- Agree upon some short-term and long-term financial goals.

- Set rules on when you need to discuss a purchase together.

- Create a written budget and revisit it every year. One option is to use our free budget sheet.

Remember, what works for one couple won’t necessarily work for another. Find a plan that fits you both. And make time to talk together on a regular basis.

Facing financial fears

Maybe your heart skips a beat when bills and bank statements arrive. Perhaps you fear your identity will be stolen or you’ll lose your job. Or you’re facing looming questions: Have I saved enough? How do I create a budget and make it work?

Here are several common financial fears and how to face them this Halloween season—and any time of year.

I fear I may never get out of debt.

How to face your fear: The scariest part is identifying exactly how much debt you have and why. Once you’ve assessed your debt, devise a plan to pay off the largest debt first. If you need some help contact our financial advisors. We’ll help you come up with a plan to get you back on track.

I fear bills and bank statements.

How to face your fear: Bills and bank statements are unavoidable, but don’t live in denial. If you’ve gotten to the point of fearing bills and bank statements, you’re probably overspending. Cut back and don’t spend more than you make. Then build a budget and stick to it. We have tools and calculators to help you.

I fear my identity will be stolen.

How to face your fear: Be diligent. Monitor your credit reports, bank statements, and transactions. Sign up to receive text or email alerts from your bank or credit union if your financial institution offers this service.

I fear I haven’t saved enough for my future.

How to face your fear: The good news is that it’s never too late to start saving! Open up a 403(b) or IRA. Pay yourself first and stick to your budget.

I fear I will lose my job someday.

How to face your fear: Prepare in advance. Establish an emergency fund and stash away at least three to six months of living expenses.

Remember, facing your financial fears doesn’t have to be frightening. The key is to identify the cause of your fears and face them by taking action, making a plan, and being realistic about your situation. We can provide some guidance. Explore our financial planning service options and contact us for an appointment.

Four financial goals for fall

How times flies! We’re already well into the new school year. Before the holidays close in, why not take advantage of the season by taking a peek at your finances? Here are four things you can do to get ahead.

1. Don’t miss the open enrollment period to participate in a 403(b)

School districts have their own open enrollment times. Check with your district office to make sure you’re not missing an October deadline.

2. Maximize your retirement savings

Could you contribute more toward your retirement yet this year? Saving more may lower your taxable income and help you reach your retirement goals. Check on 403(b) and IRA contribution limits.

3. Take stock of transitions

Summer is often a time of weddings, moving, job changes, and more. If you have had any major changes recently, now is the time to check the beneficiaries on your policies and make sure we have your correct address. It’s also a good time to review your insurance coverage to make sure you still have appropriate coverage.

4. Do a budget check-up

Use our fillable budget sheet and free financial calculators to get a good picture of your spending habits and make any adjustments necessary. It can help you set priorities, keep you from spending more than you earn, and prepare you for financial emergencies.

Before you head back to school…

Here are a few things to consider for your financial checklist before you head back to the classroom this fall.

✓ Are you contributing as much as you can toward your retirement? Consider how much you can afford to save in your 403(b) and/or IRA. Also be sure to check on contribution limits.

✓ Complete a new Salary Reduction Agreement (SRA) to give yourself a raise in your 403(b) contribution for the next school year.

✓ Review beneficiaries. If you’ve experienced any life events (marriage, divorce, birth of a child, etc.) it’s time to update your beneficiaries. Beneficiaries named on your retirement account supersede your will.

✓ Update your address, review your portfolio, and change your investment allocation. Visit yourMONEY online to review your account or make an appointment to meet with one of our financial advisors for more assistance.

✓ Have you reviewed your home and auto insurance coverage lately? Get an insurance consultation or fill out a quote form.

✓ Let your family know about the Member Benefits programs that are available to them.

This summer and anytime, call us at 1-800-279-4030 for assistance.

Financial literacy: Preventing financial fraud

Be vigilant of financial scams to help prevent any loss of your nest egg. Here are a few common ones.

Phishing is a scam in which a person uses fake emails, texts, and/or phone calls to try to get you to share valuable information such as your Social Security number, account numbers, or usernames and passwords. Once they have this information, they may steal your money, your identity, or both.

A charity scam is when a thief poses as a real charity or makes up the name of a charity that sounds real to get money from you. These scams often increase during the holiday season as well as after natural disasters and emergencies (such as the Los Angeles fires).

Impostor scammers try to convince you to send money or share account details by pretending to be someone you know or trust, like a government employee or family member.

One you may not have heard of is SIM swapping. As more mobile phones phase out their physical SIM cards in favor of digital eSIMs, a potential security hole has opened up. If someone is able to gather enough of your personal information, they may be able to convince your provider that they’re you. They then transfer your eSIM to their device, creating a gateway via your phone to your financial, social media, email, and other accounts—leaving you to clean up the mess. Setting up two-factor authentication and using a password manager are a couple of ways to help prevent this type of fraud. Learn more with FINRA’s article, Sim Swapping Risks to Investors.

If you’ve been scammed, start by reporting the incident to identitytheft.gov, filing a report with your local police department, and calling the companies where you know fraud occurred. Get more information at identitytheft.gov.

Read more: Continued from Financial literacy is for everyone.

Financial literacy: Key investing terms to know

Pretax vs. Roth (after-tax)

Traditional (pretax) retirement savings accounts allow you to defer the taxes on your contributions and at the same time reduce your taxable income. The earnings grow tax-deferred but both the earnings and initial investment will be taxed when withdrawn.

Roth accounts allow for after-tax contributions. You pay taxes now in exchange for tax-free treatment of earnings on qualified withdrawals.

Diversification

Having different types of investments in your portfolio helps manage risk. Historically, it also yields higher returns as the positive performance of some investments offset the negative performance of others.

Asset allocation

This is how you divide your money among stocks, bonds, and short-term reserves. The aim is to control risk by allocating your portfolio according to your time horizon and tolerance for fluctuations in value.

Risk

Before you consider any investment, you need to understand risk and determine your personal risk tolerance. Lower-risk investments have averaged modest long-term historical returns. Higher-risk investments, such as large company, small company, and foreign stocks, have averaged higher returns historically, but with more fluctuation in value.

Fees

The impact of fees over time on your IRA or 403(b) account can significantly reduce your nest egg. Pay attention to all of the costs, including plan fees and mutual fund expense ratios. Not all providers or funds charge the same fees or advisor management costs.

Neither diversification nor asset allocation ensure a profit or guarantee against a loss.

Read more: Continued from Financial literacy is for everyone.

Financial literacy is for everyone

In our Fall 2024 issue, we highlighted Wisconsin educator Kerri Herrild and her work in helping pass a law requiring high school students in our state to take a financial literacy course.

We applaud the decision and know it will make a positive difference in many young people’s lives. But we also want to acknowledge something just as important—that financial literacy isn’t just for the young.

At Member Benefits, we hear members talk about how they wish they knew more when they were younger. But the good news is that there’s always something new to learn. It’s never too late to become more financially knowledgeable, no matter what your age.

With that in mind, we’ve put together some helpful financial tips and resources. We hope it will make it easier to get you started on your financial journey…or to continue on your path of learning.

So now that your students are set to become more financially literate in the coming years—how about you?

Budgeting

Building a budget calls for an investment of time up front and requires you to face the good and the bad of your financial situation. But the pay off and benefits are long lasting.

Writing a budget helps you set up and achieve goals by:

- Establishing priorities.

- Giving you permission to spend.

- Helping you save money for long- and short-term needs.

- Preparing you for financial emergencies.

Use our budget worksheet and financial calculators as a guide, and/or schedule a financial planning consultation to help you get started.

Managing debt

Spending more than you earn on a consistent basis can build debt quickly. Having a budget can help you prevent the problems that come with that.

Being in debt has a BIG impact on financial wellness by affecting your credit score, paying higher interest rates, making it harder to get a loan, etc., as well as taking a toll on your mental and physical health.

If you’re carrying too much debt, devise a plan to pay off the highest interest debt first. Paying off your outstanding bills has many benefits—it improves your credit score, reduces stress, and increases your financial security. If you need some help, contact one of our financial advisors. And use our online debt calculators as a resource.

Saving

The phrase “pay yourself first” can be a powerful savings strategy. It means you pay into your own savings and investments before anything else.

There are three types of savings goals you may want to achieve, which will change depending on your age. For example:

- Short-term (0-5 years): Emergency fund, vacations, start a family.

- Intermediate term (5-10 years): New car, new home/condo, college fund.

- Long-term (10 years or more): Retirement savings (IRA, 403(b), etc.).

An emergency fund is critical—there will always be surprise financial situations that pop up in daily life. Start with a goal of saving at least three months worth of expenses in your emergency fund. Six months is even better if you can do it. Consider setting up a recurring transaction to place money in your emergency fund each month. If you need to, take it slow and just save $20 per paycheck, increasing as you are able.

Saving for retirement earlier than later gives you a huge advantage by utilizing the power of compound earnings over time. Setting up automatic contributions into your retirement account using payroll deduction or electronic funds transfer can make saving easier to do.

You’ll also want to save enough for a potentially long retirement—it’s easy to forget the fact that we are living longer, often into our 80s and 90s. Depending on when you retire, you could be looking at 30+ years outside of the workforce.

Investing

Though many people think of them as the same thing, saving and investing are different.

- Saving money has a shorter-term horizon and a low risk of losing value, but generally has lower returns over time. It commonly utilizes savings accounts, CDs, or money market accounts to save and preserve assets.

- Investing has a longer-term horizon and comes with risk, including loss of principal, but also has the potential for higher returns—though they are never guaranteed. It is a strategy used to save for long-term goals, such as retirement or saving for college, and utilizes stocks, bonds, mutual funds, and ETFs.

The idea of investing can be intimidating for some people. However, being a good saver is far more important than being a skilled or knowledgeable investor. Simply getting started is key. In fact, waiting to invest can make a significant negative impact on how much you’re able to save over time.

Investing can help grow your wealth by potentially:

- Providing you with retirement savings.

- Helping you get out of a financial predicament.

- Becoming an additional source of income.

Before you start investing:

- It’s important to balance the potential gains with the risk involved.

- You’ll want to be in a good financial position to invest, such as having manageable debt and an adequate emergency fund, so you can ride the ups and downs of the market without having to withdraw from your investments.

- The earlier you start to invest, the better due to compound interest. But it is never too late to start investing.

Protecting

Many people don’t think about insurance as a way to conserve money. But if you don’t have the right coverage, you put yourself at financial risk.

For example, umbrella (personal liability) insurance is an often misunderstood coverage because many people assume their basic insurance policy offers them adequate protection. However, you may be surprised at the situations in which you may need umbrella insurance—your dog bites a neighbor, someone slips on your sidewalk, or your teen throws a party while you’re gone and one of the guests gets an Operating While Intoxicated (OWI) on the way home. An umbrella policy provides extra protection for you as well as other members of your family.

In general, we suggest you consider three principles to help find the right insurance coverage for your needs:

- Buy the right amount of protection for your situation.

- Buy more liability protection rather than less.

- Choose the highest deductible amount that you can comfortably afford.

While many companies offer auto, home, and umbrella insurance, ours is the only one created exclusively for public school employees like you. Set up a consultation and we’ll review your coverage so you can compare.

And if you have any recreational vehicles or classic cars, make sure they’re covered, too. We can help with that.

Credit score

As we mentioned earlier, debt can negatively affect your credit score. FICO (Fair Isaac Corporation) credit scores are used by financial institutions and credit card companies to determine whether you can get a loan and at what interest rate. It uses information from a consumer’s credit report to indicate the ability to repay amounts borrowed.

Information in your credit report is used in various ways. For example, credit card companies may give you a more favorable interest rate and a larger line of credit with a higher score. Potential lenders, landlords, insurance companies, and even some employers use your credit score to help make decisions about you. Companies use different sets of factors related to your score to make their decisions, so it’s safe to say that the higher your score, the better.

Employee benefits

According to the Employee Benefit Research Institute, only about 55% of workers say they understand their workplace financial benefits well. Taking advantage of all the benefits offered to you at work can help you boost your wealth as well as your job satisfaction. For example, if your district offers a match in their 403(b), take it—it’s free money.

If you’re not clear on the workplace benefits available to you, contact your human resources department or district office. Make sure you know about any post-employment benefits that may be offered as well.

Tax benefits

Another way to safeguard your wealth is by taking all the tax credits and deductions you are qualified for each year. Common ones to watch for may be based on your income, on paying for higher education, or on putting money into a retirement or health savings account. As an educator, you may be eligible to deduct expenses for classroom materials. Be sure to consult your tax advisor to know what you qualify for.

Borrow smart

It can be tricky, but one key to building financial security is to borrow only what you need. You are likely to need a loan to purchase a house or car, or to pay for college education, for example. But ask yourself questions first: Just how expensive of a house do you need? Do you really need a premium packaged car? The less you borrow, the more you have to spend on other financial goals, material goods, and life experiences.

Get support

The foundation underlying Member Benefits’ offerings of products and services is one of financial education. It underscores everything we do. So please turn to us with your questions, learn from our resources, and consider our program options. We are here to help every member become financially secure.

April is National Financial Literacy Month

We love the national focus on financial literacy because it reinforces our belief that education is fundamental to the financial security of those we serve.

To help you achieve your financial goals, consider these resources that promote financial literacy in April and all year long. You’ll find a wealth of knowledge for your personal financial plans as well as financial literacy resources for your classroom.

Money Management International’s 30 Steps to Financial Wellness

April is officially Financial Literacy Month, but you can pledge to take these 30 steps any time you’re ready! The 30 steps are designed to help you identify your money weaknesses and turn them into strengths.

Retirement Toolkit

The Employee Benefits Security Administration offers a list of publications, videos, and interactive tools to help in your retirement planning.

FDIC – Money Smart

A financial education program can help people of all ages enhance their financial skills and create positive banking relationships.

MyMoney.gov

MyMoney.gov provides information about and links to a collection of federal guides and curricula for teaching financial capability concepts.

Jump$tart Coalition for Personal Financial Literacy

A national non-profit coalition of organizations dedicated to improving the financial literacy of pre-kindergarten through college-age youth. Download free national standards, comprehensive content based financial education, a database of resources, and more. Click here for Wisconsin’s Jump$tart page.

Edutopia: Resources and Downloads for Financial Literacy

A comprehensive list of links to resources to help students learn financial concepts, practice money management, and build strong financial decision-making and economic-reasoning skills.

AnnualCreditReport.com

The official site to get your free annual credit reports. Credit reports play an important role in your financial life and its a good idea to regularly check your credit history.

Don’t forget to set up your personal financial consultation

Make an appointment for a financial planning service* with Member Benefits. Or call 1-800-279-4030. Summer appointments fill up fast.

*These products and services are offered to Wisconsin residents. All investment advisory services are offered through WEA Financial Advisors, Inc. Consultation is free; however, if you choose to invest in the WEA Tax Sheltered Annuity or WEAC IRA program, fees will apply. Consider all expenses before investing. Must meet eligibility rules to participate. Family members may also be eligible. Call for details.

Saving by the decade – Finish strong

Building that nest egg for your daily needs can be a challenge. And for many, the idea of saving for retirement is often a ‘tomorrow’ idea—until it becomes ‘soon.’ But the longer you wait to save, the more it can cost you. We share some general guidelines to make saving a bit easier by the decade.

Your 60s: Finish strong

This is a time to set yourself up to enjoy retirement. According to Social Security’s life expectancy calculator, the average age someone age 65 can expect to live to is 84.2 for males and 86.8 for females. However, one out of three males and one out of two females who are in their mid-50s today will live to age 90 (Society of Actuaries Age Wise Longevity Infographic Series, 2019). So you need to plan for at least two decades of retirement, perhaps even longer.

Financially, it’s time to decide on when to take Social Security and to make your final decisions regarding WRS. Your estate plans, life insurance, health insurance, and long-term care insurance policies should all be in order.

In this decade (or before), you may be visited by other companies regarding your retirement accounts. Be sure you understand all costs involved, including advisory fees or annuities you may be locked into before you make a decision to move your money.

If you’ve had several jobs, may want to consider consolidating accounts with Member Benefits to minimize costs. Our financial advisors can help you evaluate retirement plans, help you shift your risk, or do a comprehensive Retirement Income Analysis to define your retirement goals, evaluate your financial position today, and determine whether you are on track to meet your goals and create a withdrawal strategy.

You’ll also want to understand and plan ahead for the annual RMD you have to start taking out of your retirement account once you reach RMD age (unless it’s a Roth IRA).

Member Benefits can help turn your retirement savings account balance into income during retirement with yourINCOME PATH, a suite of solutions and support we offer that includes a range of flexible withdrawal options to meet cash flow needs, RMD support, qualified charitable distributions, Roth conversion strategies, and more. There are no additional costs for this service if you have an account with us.

Revisit your plan often

None of our suggestions need to be limited to a specific decade of your life—many of them apply to other decades and across your career. Of course, depending on what age you are now, things may change quite a bit by the time you reach future decades. Be ready to tweak your plan, keep yourself informed over time, and visit your plan often.

If you weren’t able to start saving in early in life, remember—no matter what decade you’re living in, it’s never too late to start.

<<Part 4, Catch up

>>Return to Part 1 of our series on saving in your 20s.

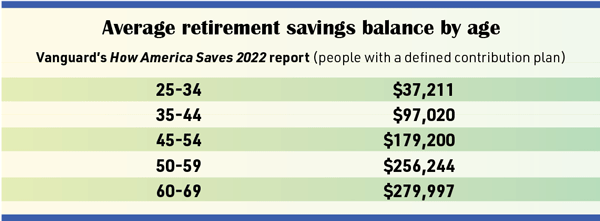

Sources: Citizens First Bank, Forbes, Vanguard.

Your actual situation may be different depending on future rates. No guarantees are expressed or implied. If you choose to invest in the 403(b) or IRA programs, fees will apply. Consider all expenses before investing. Mutual fund management and redemption fees may apply.

Saving by the decade – Catch-up if needed

Building that nest egg for your daily needs can be a challenge. And for many, the idea of saving for retirement is often a ‘tomorrow’ idea—until it becomes ‘soon.’ But the longer you wait to save, the more it can cost you. We share some general guidelines to make saving a bit easier by the decade.

Your 50s: Catch-up if needed

For many people, this tends to be a good earnings decade, so take advantage of it. Now is the time to figure out what you may be missing and catch up if you’re behind. Both the 403(b) and the IRA allow an age 50 and over catch-up option (learn about contribution limits). Some districts may also offer a 15 years of service catch-up provision in their 403(b) plan. Contact your district office to learn more.

If you can accomplish it, your debt should be paid off except for a mortgage and potentially your cars. Keep up your emergency savings to equal three to six months of salary.

It may be hard to hear, but you also qualify for some senior discounts in this decade—why not embrace them?

If you don’t have a life insurance policy yet, now is a good time. You may also want to consider long-term care insurance. Most costs for extended care needed during recuperation from strokes, accidents, illnesses, and operations are not covered by health insurance or Medicare. And it may be less expensive to start a policy while you are relatively young. Associates of Clifton Park is our long-term care partner and can tailor a policy to cover many circumstances.

Now is also a good time to start learning about your benefits with the Wisconsin Retirement System (WRS), Social Security, and Medicare. Download our free 20 WRS FAQs eBook to get started.

As you get closer to retirement, you may want to start considering where you might live and what you will do for work, personal insurance, and health insurance. Our financial planning advice options can help you evaluate your current investment portfolio or explore whether you’re on track for retirement. And if you are close to retirement, our financial planners can help you define your retirement goals, evaluate your financial position, and create a plan to turn your retirement savings into income during retirement.