Welcome Milwaukee Teachers’ Education Association members!

Enroll in the 403(b), find retirement savings information, and register for financial events.

Enroll in your district’s 403(b) retirement savings plan

Start saving for your financial future.

Calendar of events

Attend an upcoming seminar or

financial consultation

at your district.

Save for your future

Save for your future

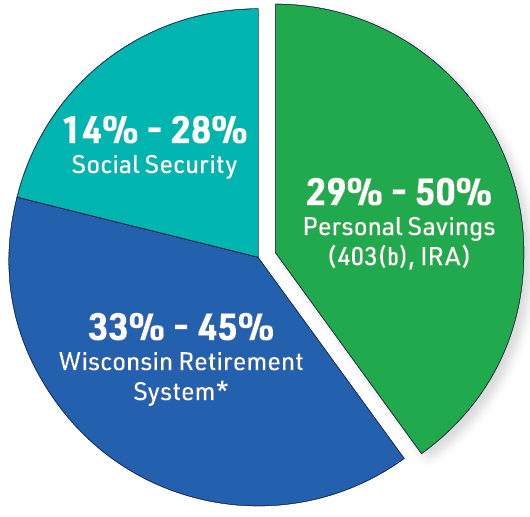

Most Wisconsin public school employees will need more than Social Security and their pension in retirement—the rest is up to you. WEA Member Benefits’ nationally-recognized 403(b) retirement savings program can help you meet your personal savings goals. It also provides tax-advantaged savings options for public school employees. The 403(b) is similar to the 401(k) in the private sector.

We also offer Individual Retirement Account (IRA) options as another great way to save for retirement. Both Roth and Traditional IRAs are available. Plus, your family members (spouse, children, parents, and parents-in-law) are also eligible for our IRA program.

Chart illustrates sources of income for most Wisconsin public school employees. *The percentage of salary replaced is tied to how many years one works in state service. The 33%-45% figure assumes 25-33 years of WRS service and depends on individual circumstances.

Insure what matters to you

Insure what matters to you

Many people don't realize that the coverage that personal insurance provides is a very important part of your financial health. You work hard for what you have, so protect it with someone you can trust like Member Benefits. Our discount programs and payment options make managing costs and budgets easy.

Explore our insurance products to cover your home, auto, and much more.

Request a quick quote Sign up for an individual phone consultation

Get expert help

Get expert help

Get a plan for your future by making a financial planning appointment with one of our financial advisors. Whether your wondering if your investments are still aligned with your financial goals, wanting to determine whether you're on track to retire, or determining your readiness for retirement, we can help you a game plan for making important retirement decisions.

For over 50 years, WEAC members have enjoyed the quality financial programs offered by Member Benefits—programs made available by their union.

WEAC created programs such as our nationally recognized 403(b) and personal insurance programs to give members a quality alternative to for-profit providers of financial services.

While eligibility for these programs is generally extended to all Wisconsin public school employees, WEAC members receive preferred pricing as an added value to their membership. Plus, family members may be eligible for most programs.

Check out the WEAC Member Discount Flyer!

Financial seminars

See all available seminars from Member Benefits.

_____________________________________________________

Seminar: Get on Track to Financial Security

When: Monday, March 23 – 5:00 PM

Where: MTEA Executive Board Room

What:

This seminar is designed to teach employees of all ages the basics of investing and retirement planning. In this session we provide information about how to achieve long-term financial goals. You will also:

- Determine your retirement income needs.

- Learn what retirement income sources are available to you.

- Learn the importance of reducing product fees and tips about how to make your money work harder for you.

- Learn about the advantages of different savings options (Roth IRA, Traditional IRA, TSA, or 403(b), and deferred compensation.

- Learn how to properly diversify your investment dollars.

Register: https://calendly.com/nwhitlowwea/get-on-track-to-financial-security-march-2026

Seminar: Investing Basics

When: Tuesday, March 24 – 5:00 PM

Where: MTEA Executive Board Room

What:

Learning the basics of investing is the first step to building an investment strategy. Many never get past this first step because they don’t have the time or are afraid it’s too complicated. If this describes you, this is your chance. Whether you are just starting out or have been investing and want to know more, this one-hour seminar will be a good investment of your time.

You will learn:

- About the different asset classes and the role each plays in an investment portfolio.

- How history lessons can help you with long-term investment strategies.

- The importance of diversifying your investments.

- About your risk tolerance.

- How to avoid common investment mistakes.

- How fees impact your investment returns.

Register: https://calendly.com/nwhitlowwea/investing-basics-march-24-2026?month=2026-03

Seminar: Retirement Planning

When: Thursday, March 26 – 5:00 PM

Where: MTEA Executive Board Room

What:

Wisconsin public school employees approaching retirement typically have questions about what they need to do to prepare. This information is appropriate for those within 10+ years of retirement and will provide:

- An overview of the sources of retirement income available to public school employees, including the Wisconsin Retirement System, Social Security, and personal savings.

- Information on how to determine your retirement income needs.

- An understanding of common roadblocks to successful retirement planning.

- A pre-retirement checklist of important things to consider.

- Tools and solutions for achieving retirement goals.

Register: https://calendly.com/nwhitlowwea/retirement-planning-march-26-2026?month=2026-03

Seminar: Preparing for Retirement *Popular Seminar*

When: Wednesday, April 1 – 12:00 PM – Lunch will be served

Where: MTEA Executive Board Room

What:

This comprehensive session is recommended for employees within 5-10 years of retirement and covers the different retirement planning solutions available and the implications of the decisions employees make as they approach retirement. The session covers:

- The sources of retirement income available to public school employees including the Wisconsin Retirement System (WRS), Social Security, and personal savings.

- The various annuity options available from the Wisconsin Retirement System.

- Retirement timeline (including eligibility dates and requirements for WRS withdrawals, health insurance, etc.

- Personal savings withdrawal issues and tax implications.

- Common roadblocks to successful retirement planning.

- A pre-retirement checklist of important things to consider.

- Tools and solutions to help employees reach their retirement goals.

Register: https://calendly.com/nwhitlowwea/preparing-for-retirement-apr-1-2026?month=2026-04

Seminar: Wisconsin Retirement System (WRS): Your State Pension Plan

When: Thursday, April 2 – 12:00 PM – Lunch will be served

Where: MTEA Executive Board Room

What:

WRS, the state pension plan, will be a source of retirement income for most Wisconsin public school employees. Understanding this benefit will help educators better plan for their future. Learn to:

- Read/interpret your pension statement.

- Calculate your WRS pension benefit.

- Choose an appropriate annuity option.

- Purchase forfeited service.

- Determine whether you will have a retirement income gap.

Register: https://calendly.com/nwhitlowwea/wrs-apr-2-2026?month=2026-04

Milwaukee Public Schools 403(b) Enrollment Packet

Thank you for your interest in our 403(b) application. Please fill out the form below to access the enrollment packet:

"*" indicates required fields

Personal financial consultations

One-hour financial consultation with N’Kenza Whitlow

Phone Appointments

Insurance consultations

30 minute consultation with a licensed insurance consultant

Phone Appointments

Your Retirement Journey

Wherever you are in your journey, this video has tips and information for everyone!

Created by educators

WEA Member Benefits

Over 50 years ago, we were created by Wisconsin educators for Wisconsin educators. No other financial organization can say this. Explore our unique programs and services.