Financially savvy millennials have a Roth IRA…here’s why

No taxes (on earnings or qualified withdrawals)

That’s right. Your retirement savings account grows absolutely tax free and you won’t owe a dime when you start taking withdrawals as long as your follow the IRS rules. This is because Uncle Sam takes taxes out before you invest it. It’s like prepaying your taxes. The frosting on this cake is that you are not taxed on any account earnings. Hard to believe, I know. Don’t question it, just go with it.

Just $20

That’s all you need to start a Roth IRA with WEA Member Benefits. Other providers may require $500 or $1,000 to open an account, but we think you should be able start with whatever you can afford. A comfortable retirement is an expensive proposition. But, starting sooner even with as little as $20 per pay period can make a significant difference in your financial future.

Flexibility

A Roth IRA is also more flexible than other retirement savings. Although the purpose of a Roth IRA is to save for retirement—long-term savings—access to your contributions is much easier than say in a 403(b) or 401(k) account. However, withdrawing from your account is not recommended because your money needs to be in the account so it can grow, but if you have an emergency and have no other options, it’s nice to know it’s there.

PLEASE NOTE:

Contributions is italicized in the previous paragraph for a reason. Withdrawing any of your earnings before age 59½ will trigger a tax bill on the money, plus you’ll have to pay a 10% penalty. So you won’t want to do that. Unless…you want to tap your Roth for either of these two reasons and qualify.

- To buy your first home. If you use your Roth IRA for a first-home purchase, in addition to using your contributions for the down payment, you can also withdraw up to $10,000 of earnings tax- and penalty-free if the account has been open for at least five years. Even if you fail the five-year test, the withdrawal will still be penalty-free, but you will have to pay tax on the withdrawn earnings. The $10,000 limit is per person, so couples could withdraw up to $20,000 of earnings if they each have a Roth IRA.

- To pay for college. Many parents don’t know whether to save for retirement or their child’s college tuition. Retirement always wins that debate. There are lots of finance options for a college education; for retirement, not so much. A Roth IRA is a great way to cover plan for either. Focus on your retirement now, saving as much into a Roth as you can. And as your finances allow, consider opening a 529 plan, like Wisconsin’s Edvest. When the tuition bill comes due, you can see where you’re at.

Pump up your retirement savings

The 403(b) is a great way for public employees to save for retirement. As a Wisconsin public school employee, you need WRS, Social Security, AND personal savings for your retirement plan to be complete.

Take a few steps to help you decide how much you would like to save in your 403(b).

- Get our free 403(b) enrollment guide and learn more about 403(b) options and benefits, savings tips, choosing an investment strategy, determining your risk, and more.

- Review contribution limits to help you evaluate how much you’re putting towards retirement and whether you’re saving enough to meet your future goals.

- Decided to change the amount you’re saving? To update your SRA, please contact your school district business office for their most recent SRA, download our SRA form, or if your district allows, update your SRA online through yourMONEY.

If you have questions or need more guidance, give us a call at 1-800-279-4030 or schedule a personal consultation.

Understanding stable value investing

If you’ve been watching some of the money market rates at banks and credit unions recently, it may be tempting to transfer all or some of your retirement money to one—or several. After all, some of them have a higher interest rate than you’ve seen in several years, so it would make sense, right? But when it comes to your retirement savings, short-term thinking isn’t necessarily a good strategy. The fact is that successful fixed-income investing remains a long-term game.

Before you make any financial moves you may regret, we want to help you understand the fundamentals of stable value investing, the current state of the interest rate market, and what you need to know to make sound investment decisions. This includes the role that stable value funds like the Guaranteed Stable Investment* (GSI) have in your overall portfolio. It will also help answer the question, “Why is the GSI rate lower than what I can get at a bank right now?”

Slow and steady

Retirement accounts are meant for long-term investing, and so is the GSI. Transactional accounts, like money market accounts offered by banks and credit unions, are meant for short-term saving strategies. This also makes them more sensitive to changing interest rates, which can cause them to change their rates more quickly.

It may help to think of a quick analogy. Say there are two boats heading toward a destination. The GSI is like a large ocean liner and transactional accounts are like a sailboat. Over a long journey, the ocean liner handily outpaces the sailboat and is less affected by wind movements (interest rates). During the journey, if both boats had to make a sharp turn to correct their course, the sailboat would be capable of making that turn quickly, while it would take the ocean liner some time to make that maneuver. It might temporarily appear that the ocean liner is off course and that you’d get to the destination faster in the sailboat. But once the liner completes its turn, it will again outpace the sailboat on the way to the destination.

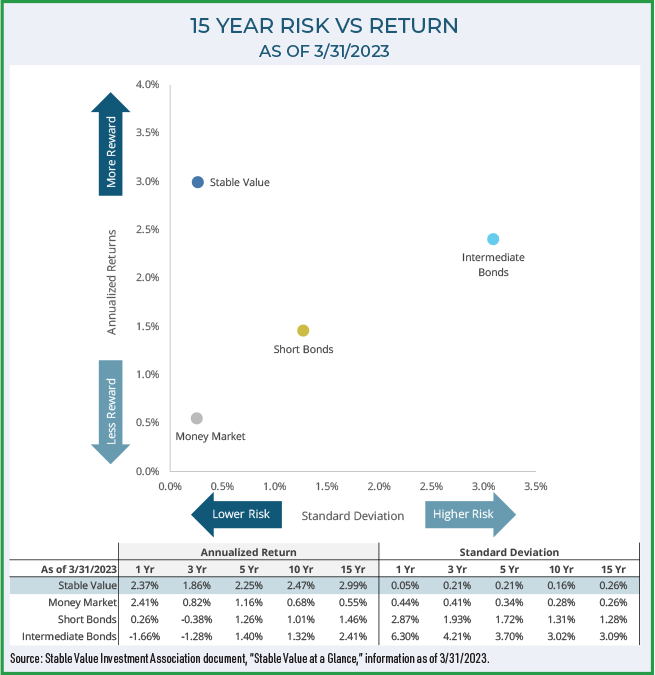

If you think of the destination as your retirement goal, it becomes clearer. Take a look at the graph below. Historically, stable value funds have provided a return above short-term bank savings products. Last year is the first time in many years money market funds outperformed stable value funds. Why? According to Vanguard, “The Federal Reserve has been raising interest rates at the fastest pace in history to combat the highest inflation seen in decades. Both money market and stable value funds are focused on capital preservation and secondarily on providing current income. But they feature several important differences. Historically, because of the longer-term nature of stable value fund holdings, they have usually returned a premium over money market funds: 1.33% on average annually over ten years and just over 2.00% since 1990. Generally, periods of money market funds outperforming stable value funds are limited in nature and unsustainable.”**

It’s clear that this inversion is unusual—and likely temporary.

GSI vs money market accounts

The GSI and money market accounts are very different from one another. Unlike money market accounts, stable value funds like the GSI are not built to pivot quickly along with changes in interest rates. Stable value fund crediting rates typically take longer to respond to changes in market interest rates—both during times of rising and falling interest rates. This is a benefit to participants when interest rates are dropping or at a sustained low level, because participants continue to benefit from a higher crediting rate for a longer period.

The other side of the coin is that when market interest rates rise—especially when they rise rapidly—the crediting rate takes time to respond. Rates were low for a long time, so the investments within the GSI portfolio still carry those lower interest rates. This will change as those investments reach maturity.

Obviously, money market accounts can sometimes pay higher interest rates than other types of savings accounts such as stable value. We’ve been asked at times why Member Benefits doesn’t offer a money market account. The short answer is that when offering a stable value fund, there are certain “competing funds” that may not be offered in the investment lineup, such as a money market fund. Stable value could be removed from the program to make room for a money market option, but as the charts and graphs throughout this article demonstrate, that would not be a wise decision when saving for the long-term.

Consider the graph above. An analysis of the last 15 years shows that stable value funds provide a higher annualized return than money market funds—with exceptionally low volatility.

Mike Driscoll, Managing Director of Sheridan Road and an Accredited Investment Fiduciary, has over 40 years of experience in the financial industry. Mike is also a longtime consultant to WEA Member Benefits. He sums it up by explaining, “The rapid rise in short-term rates since March of 2022 was the largest increase in rates since the 1980’s. The stable value asset class performed as expected and delivered on its primary investment objective of preserving investor capital and providing a competitive yield versus other low-risk alternatives. As interest rates stabilize, we expect to see stable value fund crediting rates gradually reset higher as they reflect the new elevated level of interest rates.”

Stay on course

We are in an unusual interest rate environment, so it can be tempting to make decisions based on short-term circumstances. But unfortunately, if you decide to move out of our 403(b) or IRA program, you may not be able to come back.

Navigate your retirement journey with the big picture in mind and don’t let temporary circumstances dictate your long-term decision-making.

*Interest is compounded daily to produce yield net of Empower’s administrative fee of 0.60%. EAIC is compensated in connection with this product by deducting an amount for investment expenses and risk from the investment experience of certain assets held in EAIC’s general account.

** Vanguard, Perspectives, May 18, 2023; Morningstar data as of 3/31/23.

Facts about Roth IRA contribution eligibility

The 2024 Roth IRA contribution limit is $7,000 for those under age 50 and $8,000 for those 50 and older.

IRA contribution limits include the combined limit for both the traditional and Roth IRA. For example, if you are under age 50 and you contribute $5,000 to a traditional IRA this year, you can contribute up to $2,000 to your Roth IRA, if eligible.

Your Roth IRA contribution limit, or eligibility to contribute at all, is dictated by your income (household modified adjusted gross income (MAGI)).

Roth IRA income requirements for 2024

| Filing status | Modified adjusted gross income (MAGI) | Contribution limit |

|---|---|---|

| Single individuals | < $146,000 | $7,000 |

| ≥ $146,000 but < $161,000 | Partial contribution | |

| ≥ $161,000 | Not eligible | |

| Married (filing joint returns) | < $230,000 | $7,000 |

| ≥ $230,000 but < $240,000 | Partial contribution | |

| ≥ $240,000 | Not eligible | |

| Married (filing separately) | < $10,000 | Partial contribution |

| ≥ $10,000 | Not eligible |

Depending on your MAGI and tax filing status, you are either eligible to contribute to your Roth IRA up to the full IRA maximum, contribute only a partial amount, or contribute nothing at all.

You can’t contribute more to your Roth IRA than your earned household income. If your earned income is less than the contribution limit, then your personal IRA contribution may be limited by your earned income.

Spousal contribution limits may be limited by your spouse’s income if you have no income yourself and are contributing to a spousal IRA.

Always consult a tax advisor if you have questions around your eligibility to contribute.

Moving money myths

Myth #1: You have to move your money out of WEA Member Benefits because…

Despite what you might hear, you DO NOT need to move your money from your 403(b) or IRA with Member Benefits if you:

- Retire or leave your job to take another job (even if it’s not in education).

- Turn (insert any number) years old.

- Move out of Wisconsin.

Myth #2: You won’t have access to your 403(b) funds in retirement because it is in an “annuity” (tax-sheltered annuity).

Our program has flexible withdrawal options without surrender periods (the amount of time an investor must wait before withdrawing funds from an annuity without penalty). Often individual annuities or insurance company annuities have surrender/maturity periods that are many years long (sometimes up to 12 years). Ours doesn’t.

Myth #3: There are fees to get funds out of your account upon retirement.

Nope! Member Benefits does not charge transactional fees or surrender charges even if you move your money out. (Mutual fund management and redemption fees apply.)

Have questions? Contact us at 1-800-279-4030.

This is the second article in our series. Read more:

- Moving money matters (first article)

- Moving money concerns (third article)

Create or change IRA contributions online

When you log in to your IRA retirement account through yourMONEY, you have the option of starting or changing your contributions in the portal.

You can choose between a one-time or a recurring contribution. A one-time contribution is a lump sum contribution and may take 7-10 days to process, while a recurring contribution is a monthly scheduled contribution that is automatically pulled from your bank account on or around the 15th of each month.

It’s simple and straightforward to do:

- After logging into your yourMONEY portal, click on the Plans header.

- Hover your mouse over ‘Contributions’ and select either ‘One-Time Contribution’ or ‘Recurring Contribution.’

- Fill in the necessary information, including the name of your financial institution, routing number, and your account number.

You can modify or cancel your contribution choices at any time. Cancel or modify a recurring contribution by the 13th for it to be effective the same month.

To learn more about managing your IRA contributions in yourMONEY, view a quick video or call us with any questions at 1-800-279-4030.

Why save with an IRA?

Many Wisconsin public school employees use personal savings from a 403(b) to supplement what they plan to receive from the Wisconsin Retirement System when they retire. Why? Because most people will need more than Social Security and their pension in retirement. Adding an IRA to your personal savings portfolio adds flexibility and may help you better meet your retirement goals.

Types of IRAs

Traditional IRA contributions may be tax deductible and the earnings are tax-deferred while accumulating in the account; however, contributions and earnings are taxable when distributed.1

Roth contributions are after-tax, which means you pay taxes now on your contributions, but all qualified withdrawals, including earnings, are tax-free.2

If you think your tax rates will go down in the future, a traditional IRA might make sense. The Roth may be a better choice if you think your tax rate will go up in the future, especially if you are early in your career. And regardless of tax rate changes, you’ll still enjoy a 0% tax rate on qualified withdrawals from a Roth IRA.

Why invest in an IRA?

If you have an employer match in your 403(b), you should contribute enough to receive the maximum employer match. Once you’re hitting the match, you may want to diversify with an IRA, which may offer additional fund options.

If your employer doesn’t offer a Roth 403(b), a Roth IRA can help you plan for a mix of pre- and post-tax dollars in retirement.

In 2024, you can save up to $7,000 in total annual contributions ($8,000 for age 50 and over). However, you can contribute a smaller amount of your choosing. Automating your contributions makes it easy to contribute.

Why save with Member Benefits?

- Our buying power provides access to lower cost share classes.

- We do not charge additional fees for every contribution, for a trade, etc., and we don’t have commissions or investment management fees.

- Choose from advisor-managed portfolios, target retirement funds, or hands-on investing strategies for no additional cost.

- You can rollover a 401(k) or other retirement account into an IRA.

- Your family can participate if they live in Wisconsin or several other qualifying states. Ask us about requirements.3

Open an IRA account

One low annual administrative fee (0.45%) up to an annual fee cap4 ($600 for WEAC members or $750 for non-members).

1 Consult with a tax advisor to determine the extent of your ability to deduct your contributions.

2 For qualified Roth IRA withdrawals, the participant must be age 59½ or older and have held the Roth IRA account for at least five tax years.

3 To be eligible for this program, you must meet the IRS eligibility requirements for contributing to an IRA. Restrictions may apply. Certain state residency required. Visit weabenefits.com/ira for details.

4 An annual minimum account cost of $25 applies to all accounts. The minimum is waived for all accounts with active contributions. Mutual fund management and redemption fees may apply.

yourINCOME PATH

yourINCOME PATH™ is the suite of options Member Benefits offers to help you turn your retirement savings account balance into income during retirement.

What can yourINCOME PATH help me with?

Examples include:

- A range of flexible withdrawal options to meet cash flow needs.

- Required minimum distribution (RMD) support.

- Qualified charitable distributions (QCD).

- Retirement account consolidation.

- And more.

How much does it cost?

There are no additional costs for these services.* You have the power to start, stop, or adjust your income at any time. There are no sales costs or hidden fees associated with any of our investment options.

Visit yourINCOME PATH to explore what resources are available for YOU!

*If you choose to invest in the WEA Tax Sheltered Annuity or WEA Member Benefits IRA program, fees will apply. Consider all expenses before investing.

3 things you may not know about an IRA

In 2023, the annual contribution limit for an IRA is $6,500. In 2024, the limit on annual contributions to an IRA will increase from $6,500 to $7,000.

A nonworking spouse can open and contribute to an IRA

If one spouse is working and the couple files a joint federal income tax return, the nonworking spouse can open and contribute to their own traditional or Roth IRA. A nonworking spouse can contribute as much to a spousal IRA as the wage earner in the family.

Self-employed or have a side hustle? Save with a SEP IRA

If you are self-employed, you can open a Simplified Employee Pension plan—more commonly known as a SEP IRA.

Even if you have a full-time job and earn money freelancing or running a small business on the side, you could take advantage of the potential tax benefits of a SEP IRA. The SEP IRA has a much higher contribution limit than a traditional IRA. The amount you can put in varies based on your earned income.

Traditional IRAs require you to take required minimum distributions—Roths don’t

Traditional IRAs require you to take taxable required minimum distributions (RMDs) at a certain age—Roth IRAs don’t. You’ll need to withdraw the minimum amount in a traditional IRA by the deadline or you’ll be subject to a 50% tax penalty.

Since Roth IRAs aren’t subject to RMDs, you can leave the money in your account for potential growth, or withdraw it without increasing your taxable income.

For more information on the WEA Member Benefits IRA, call us at 1-800-279-4030.

SECURE 2.0 changes age for required minimum distributions

As of January 1, 2023,the Internal Revenue Service requires you to start withdrawing money from your before-tax and Roth 403(b) account at the later of age 73 or the calendar year you retire from an employer through which you contributed. These withdrawals are called required minimum distributions (RMD). Your minimum distribution is a function of your account balance and your life expectancy.

Are there any ways to eliminate the need for an RMD in my 403(b)?

Under prior law, a Roth IRA account owner did not have to take lifetime RMDs, but no such exception existed for Roth monies under 403(b) and other employer-sponsored retirement plans. SECURE 2.0 ends lifetime RMDs for Roth designated accounts in employer sponsored plans effective for taxable years beginning January 1, 2024. However, for retirees who attain age 73 in 2023, RMDs on Roth 403(b) monies must still be made by April 1, 2024.

What about my IRA?

Traditional and SEP IRA accounts also require RMDs to start at age 73. However, unlike the 403(b), you cannot delay the RMD past age 73, even if you continue to work.

What if I don’t take my RMD?

If you miss taking your RMD, the penalty is 25%, but if corrected during the two-year correction window, it is further reduced to 10%.

How does Member Benefits help?

If you have an account with us, Member Benefits will send you an RMD notice at the appropriate time and can assist you in setting up your RMD schedule. We continue to send RMD notices on an annual basis.