Trampolines: Worth the risk?

But if your plans for summer fun include using a backyard trampoline, make sure you know the risks and realities that come with it. Here’s what you need to consider.

Accidents happen

There is a surprising amount of power that can be generated from jumping on a trampoline—children can bounce up to 30 feet, according to the Consumer Product Safety Commission (CPSC). According to the CPSC, trampoline-related injuries have been increasing over the years, with an estimated 331,800 trampoline injuries treated in emergency rooms in 2019 alone.

Injuries are commonly caused by:

- Colliding with another person on the trampoline.

- Landing improperly while jumping or doing stunts on the trampoline.

- Falling or jumping off the trampoline.

- Falling on the trampoline springs or frame.

Head and neck injuries account for 10–17% of all trampoline-related injuries. These often happen with falls and failed somersaults or flips and can be the most catastrophic of all trampoline injuries suffered.

An “attractive nuisance”

You may think of trampolines as just a fun way for the family to get some exercise. But from an insurance perspective, they’re considered an attractive nuisance—something that is likely to entice children and could pose a risk of injury. Other examples include swimming pools, discarded appliances, and abandoned cars.

As the owner of the trampoline, you have the burden of taking adequate measures to protect children. Even if someone comes over and uses the trampoline without your knowledge, you may be liable for any potential injury they may suffer from it.

Will insurance cover you?

If you have a trampoline or are considering purchasing one, talk to your insurer about your home policy coverage. Typically, insurance companies handle them in one of four ways:

No exclusions. The insurance company doesn’t place any restrictions on trampoline ownership or usage in accordance with your home policy.

Coverage with safety precautions. An insurance company may include coverage if you have pads to cover the trampoline springs, a net enclosure for the sides, and/or other safety precautions.

A trampoline exclusion. Many insurance companies consider trampolines to be too hazardous to insure. This means no matter who gets injured on the trampoline or how they get injured, the insurance company will not cover those claims.

Refusal to insure the home. Some companies will not write a home policy if there is a trampoline on the premises.

Since trampolines represent a higher risk of liability, you may want to consider purchasing personal umbrella insurance. This may extend your liability protection beyond your existing home policy limit.

However, don’t just assume that because you have one or both of these policies that you are covered. Under some circumstances, you may not be. Contact your insurer so you understand your policy guidelines.

Considerations for renters

Your landlord has the obligation to keep the property reasonably safe for tenants. Since trampolines are considered an attractive nuisance, he or she may risk liability costs for allowing one. Check your rental agreement or speak with your landlord to find out whether or not a trampoline is allowed on the property.

If you decide to take the leap

If you must have a trampoline, put safety first. Take these steps recommended by the CPSC to reduce the risk of injury:

- Allow only one person on the trampoline at a time.

- Do not attempt or allow somersaults because landing on the head or neck can cause paralysis.

- Do not use the trampoline without shock-absorbing pads that completely cover its springs, hooks, and frame.

- Place the trampoline away from structures, trees, and other play areas.

- No child under 6 years of age should use a full-size trampoline. Do not use a ladder with the trampoline because it can provide unsupervised access to small children.

- Supervise children at all times.

- Trampoline enclosures may help prevent injuries from falls.

Regardless of the precautions put in place, the American Academy of Pediatrics strongly discourages the home use of trampolines. More than 1 million people visited the emergency department for trampoline injuries between 2002 and 2011, according to a September 2019 report from the AAP. Most patients were younger than 17 years.

The decision to purchase or keep a trampoline comes down to risk versus reward. While they may seem appealing as a fun summer activity, know the safety risks as well as the legal and financial risks to you and ask yourself: Are they worth it?

Don’t forget about flood insurance

In 1968, Congress created the National Flood Insurance Program (NFIP) to help provide a means for property owners to financially protect themselves. The NFIP offers flood insurance to homeowners, renters, and business owners if their community participates in the NFIP.

It doesn’t take a major body of water or even a major storm to cause a flood. You can live miles away from water and still be a victim of flooding. In fact, nearly 20% of all flood insurance claims come from areas with moderate-to-low flood risk.

Member Benefits’ personal insurance consultants can help you evaluate your need for flood insurance and give you a quote. But plan ahead! There is a 30-day waiting period.

Call us today at 1-800-279-4030.

Determining the value of your home for insurance coverage

When determining the current value of your home for insurance purposes, it is important to differentiate between assessment value, market value, and replacement cost. These values usually are not the same and serve different purposes.

Assessment value

The assessment value is the dollar amount placed on your home by your local government for taxation purposes (i.e., property taxes). Factors considered when calculating your home’s assessed value may include the selling price for similar properties in your area, the replacement cost, and the land value, depending on where you live. The higher the assessed value, the more you pay in taxes.

Market value

The market value is how much you could expect to get for your home in the current real estate market if you were to sell. The listing and selling price of comparable homes in the local area, square footage of the house, value of the land, location, amenities, condition of the property, etc., are used to determine the market value.

Replacement cost

When insuring your home, it should be insured for 100% of its replacement cost. This is different from both the assessed value and the market value. The replacement cost reflects how much it would cost to rebuild your house in the same spot with materials of like kind and quality.

Because the cost of materials and labor fluctuates (especially in recent times), it is important to evaluate your coverage periodically to make sure you have adequate protection.

Make sure you’re properly insured

Have you reviewed your home insurance coverage recently? Gaps in your insurance coverage may leave you financially exposed. Ask us about our Guaranteed Replacement Cost coverage—if you have a home insurance policy with Member Benefits and your home was built during or after 1950, we will pay the full cost to repair or replace your home with materials of like kind and quality without the limits imposed by other insurers.

We can assess your current home insurance coverage to make sure it is appropriate for your situation. Contact one of our personal insurance consultants for assistance.

1-800-279-4030 | weabenefits.com/consults

Long-term care at home is a family affair

Eileen Dunn, Geriatric Care expert from our partner Associates of Clifton Park, answers, “In my experience, probably not many. Over the years I’ve had many adult children paying for their parent’s care without their knowledge.

“I currently have a client in an assisted living facility. Each of her two children are paying $1,500 per month toward the cost of care since her Social Security and pension won’t cover all the costs and her savings ran out about a year ago. Her son told me he is happy to do it, but now it’s less that he can contribute to his own retirement.”

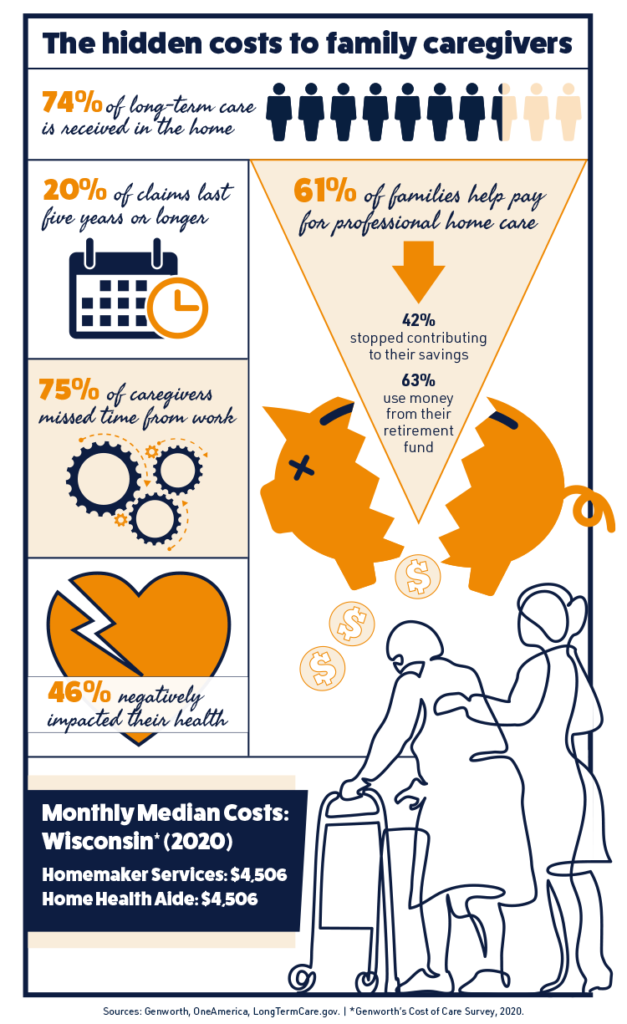

This is just one example that stresses the need to protect against the cost of home care. According to Genworth and OneAmerica, nearly three quarters of long-term care claims are for home care, not nursing home care. Eileen adds, “The main reason I’ve ever had to place someone in a nursing home is because they have run out of savings to pay for care at home.”

It’s clear that long-term care is not an event that happens to an individual, but an experience that happens to a family. And the financial and mental health consequences can have significant repercussions for caregivers if their loved one doesn’t have appropriate long-term care insurance coverage.

Home and car cold weather safety

If you haven’t done so this year, it’s time to do a little preventive work—it’ll keep you safer, warmer, and maybe even help you save some $$.

Inside the house

Prep the plumbing

Turn off the water supply to outdoor spigots and sprinkler systems to avoid burst pipes. Install pipe insulation in unheated areas of your home.

Check the chimney

Have your fireplace chimney cleaned and inspected yearly to ensure it’s not a fire hazard and that there are no critters making it their home.

Stay on alert

If you don’t have a carbon monoxide detector, get one right away. Make sure to test your carbon monoxide and smoke detectors and change the batteries. The U.S. Fire Administration states that smoke detector batteries should be replaced at least once or twice a year. If you don’t use the annual time changes to help you check every year, try making January a new year/fresh start reminder.

Give your furnace a checkup

Start out by changing your filter—it will help your furnace run more efficiently. If you haven’t had it professionally checked in the last two or three years, make an appointment.

Protect entryway flooring

Between the tracked-in snow, ice, road salt, and sand, entryway floors can really take a beating in the winter. Increase the longevity of your flooring and prevent slipping by using floor mats both inside and outside of each entrance to your home. A boot scraper or brush outside can help remove excess snow, and a waterproof tray inside is great for placing wet shoes and boots.

Check your emergency supplies

With winter storms comes more potential for power outages. Be prepared with fresh bottled water, shelf-stable foods, flashlights, batteries, first-aid supplies, and a hand-crank radio.

Keep cozy

Boost your home’s energy efficiency and save money by checking and repairing caulking around doors, windows, and anywhere something penetrates a wall. Check weatherstripping on doors and windows and seal cracks in foundation walls.

Outside the house

Ice dams

Ice is great for skating, fishing, and cooling a beverage, but icicles hanging along the eaves of your house may be a sign of trouble. Icicles and ice dams are a sign that you have insulation and/or ventilation issues in your home.

Simply knocking down icicles won’t solve the problem. Ice dams can loosen shingles, rip off gutters, and allow water to infiltrate your home. If that happens, you’ll likely have damage to your walls, ceiling, floors, and attic insulation.

Here are a few ways to help prevent icicles and ice dams:

- Keep your attic cold. Properly insulate your attic floor and be sure your attic is adequately ventilated. Install roof vents, gable vents, and/or soffit vents to ensure a well-ventilated space. An added bonus—insulating can help lower energy bills.

- Clear your gutters of leaves and debris so melting snow can drain out. If you didn’t take care of this before winter, be sure to do it in the spring and again in the fall. Consider gutter guards or hiring a service to prevent build-up and to help you avoid getting up on the roof.

- After a heavy winter storm, remove a layer of snow at least three feet above the gutter line with a long-handled aluminum roof rake while you stay safely on the ground. A rake with wheels will help prevent roof damage.

Don’t chip at ice dams with a hammer, ice pick, or shovel. It’s dangerous and can often do more harm than good. And never use salt to melt the ice. This may damage your plantings and roofing material.

Beth Gold, Claims Representative, explains, “Water damage from ice dams is generally covered on your home insurance policy but exclusions may apply. Be sure to read your policy carefully and contact your insurance company right away if you have damage.”

Driveway

Driveways are an often overlooked area of your home—until there’s a problem. Keeping it maintained can help you avoid repairs and save money. Here are a few things you can do to take care of your driveway during the winter.

- Minimize water on the driveway by clearing a two to three-inch strip of snow around the edges to provide a runoff area for snow and water. This can help reduce the chances of water penetrating the surface.

- Ensure downspouts empty into the yard rather than onto the driveway.

- For both sidewalks and driveways, don’t use cement salt or chemical de-icers, as they can penetrate surfaces and cause cracks. Instead, use a snowblower or shovel to remove snow, then use alternatives like sand, coffee grounds, alfalfa meal, or kitty litter to make surfaces less slippery.

- Raise the blade of your snow plow enough so it doesn’t scrape and damage the driveway surface. If shoveling, use a plastic shovel for uneven surfaces to reduce the risk of it catching on the driveway.

Beth adds, “A lawsuit can be very costly if you don’t prevent people from tripping on cracks and uneven surfaces, especially if you don’t have umbrella insurance. It’s inexpensive and the added protection can be well worth it.”

If you do experience home damage this winter and have your home policy with us, give us a call.

Prep for safe winter driving

Be ready for the snow before you go. Every vehicle should have an emergency supply kit in the trunk. Check your kit twice a year and replace items as needed.

- Water and snacks

- First aid kit

- Jumper cables or portable jump starter

- Road flares

- Warm clothes, mittens, boots, blanket

- Whistle

- Snow brush

- Ice scraper

- Flashlight

- Full tank of gas

- Cell phone charger

- Sand/cat litter and shovel

511wi.gov is a free website that provides information to help you make smart traveling decisions, check traffic speeds, or plan a trip. Stay informed about road conditions before you leave the house and while you are on the road.

We’re here to help

Lastly, make sure you’re properly insured. Not all policies are the same so be sure you understand what you have or what you are purchasing so you won’t find yourself short on coverage when you need it.

Get a free insurance consultation and comparison quote

weabenefits.com/consults | 1-800-279-4030

Determining appropriate life insurance coverage

Here’s a simple formula:

- SURVIVORS’ FINANCIAL NEEDS

Final expenses + debts + income needs - SURVIVORS’ FINANCIAL RESOURCES

Survivor benefits + your assets + your resources + group life insurance - DO THE MATH

Financial needs — Financial resources = How large a policy to buy

Try out our free life insurance comparison quote. No personal or contact information is ever required.

Many people are underinsured because they skip these simple steps. It’s also important to consider the timing of when your financial resources will be available to your family.

Speak with the experts at Associates of Clifton Park. They offer a variety of policies and can go through all of the factors you may want to consider. Give them a call at 1-800-893-1621.

Source: Insurance Information Institute.

Avoid home insurance claim surprises

Read your policy

Ok, most people don’t actually read their home insurance policy—it’s complicated. But make sure you do understand what coverages you do and do not have and what they mean. Misunderstanding your policy can have negative financial consequences you weren’t expecting.

The consultants at Member Benefits are happy to go through your policy with you and answer your coverage questions.

Maintain your property

Home insurance covers sudden and accidental damage, not damage from wear and tear over time. Neglecting to maintain your home won’t be covered by insurance.

Have appropriate coverage

Without the right coverage, you may find yourself owing more than you expected. Insurance is an important part of your financial security. Don’t leave yourself (and your family) exposed to financial loss or purchase coverages you don’t need.

Talk to a Personal Insurance Consultant at Member Benefits. We can help you create a policy that meets your needs.

Don’t clean up too fast

When you experience damage to your home, you may feel in a rush to clean up the mess. Don’t—it can be a financial mistake. You may end up throwing away damaged items before the total damage is documented or lose receipts you need to file a claim. Keep important documentation such as photos and repair estimates, and leave yourself a clear paper trail.

Document, document, document

One common mistake people make when filing a claim is not documenting the damage. Take photos as soon as you discover the damage. If you have some before and after photos, that’s even better.

In the event of a covered loss, you’ll need to provide a list of all of your personal property that was damaged or stolen, along with its estimated value and age at the time of loss. If you’re like most people, it would be hard to remember all of your possessions. This is where a home inventory can come in handy. An accurate inventory and proof of ownership can make the claim settlement process easier and faster.

Download and print your free Personal Property Home Inventory eBook. It has helpful tips as well as fill-in-the-blank listings room by room.

Don’t file too many claims

Insurers look at claims history when setting rates. The more you have, the higher your premiums will be because insurers correlate the number of claims to a higher risk of filing more claims in the future. Consider carefully before claiming smaller repairs you could take care of yourself.

Not realizing your house could be underinsured

Did you know Member Benefits offers Guaranteed Replacement Cost for homes built during or after 1950? This coverage is rarely offered by insurance companies today. With Guaranteed Replacement Cost, we will pay the full cost to repair or replace your home with materials of like kind and quality without the limits imposed by most other insurers.

Contact us—we can help you discover what kind of coverage your current policy offers.

Avoid unwelcome surprises…talk to us!

Set up a free consultation with one of our Personal Insurance Consultants. They can help you learn to be a better insurance consumer, review your policy thoroughly, and offer help and advice. Or get a home insurance quote.

weabenefits.com/consults • weabenefits.com/homequote • 1-800-279-4030

Source: Forbes Advisor.

Why does your home insurance premium go up every year?

Many factors go into choosing your home. Your insurance company also has many factors to consider when determining your home insurance premium. Still, it can come as a surprise when your premium goes up. Here are several reasons why you usually see home insurance premium increases each year.

Inflation. Some years are affected more by inflation than others. This year, some of the higher labor and material costs that companies have experienced due to the pandemic are being passed on to consumers, raising the cost of building a home as well as the cost of items within your home such as appliances, furniture, etc.

Construction costs. If your home needs to be rebuilt or replaced due to a catastrophe and your area has been hit with severe weather, there may be labor shortages; rates typically escalate in those circumstances. The spike in the cost of construction materials this year is also a factor.

Claims. Insurance is meant to offset the cost of major expenses if something serious happens to your home. But filing a claim may also raise your premium. Think twice about making smaller claims—if it’s not going to cost much more than your deductible, it may be worth paying out of pocket.

Changes to your property. Updating your kitchen, putting on an addition, or other large investments are going to increase the value of your home, which may increase your insurance rate.

Attractive nuisances. A swimming pool or trampoline in your yard poses a higher risk compared to homes that don’t have these items. Make sure you clearly understand your insurance company’s policies regarding attractive nuisances. You could see a rate increase or potentially lose your insurance all together.

Your insurance score. Your insurance score is calculated based on your likelihood of filing a claim during a given coverage period and on your credit score, among other things. A lower insurance score can affect your insurance premium.

Fortunately, there are ways to lower your premium, such as bundling your insurance, increasing your deductible, keeping up your credit score, avoiding small claims, and actively pursuing any discounts you may be entitled to. But be sure to alert your insurer to any changes to your home so you remain properly insured—it’s important for maintaining your financial health.

Call us if you have questions or to get a free insurance quote at 1-800-279-4030.

Money well spent

More than 1 in 5 adults—a total of 53 million adult Americans—are unpaid family caregivers, according to a 2020 report from AARP and the National Alliance for Caregiving. This type of care is provided by family or friends rather than by paid caregivers. While some aspects of caregiving may be rewarding, caregivers often experience a myriad of mental, physical, social, and financial stressors.

Long-term care insurance (LTCi) can help ease the financial pressure involved in taking care of a loved one at home. Eileen Dunn from Associates of Clifton Park shares one example of how LTCi can help reduce some of the stress that caregivers may bear.

Eileen says, “I received a call from an attorney needing help with an elderly couple. When I visited for the home care assessment, I found the husband was in poor condition. He had serious back issues and had been in bed for most of the last four months. The wife had been providing all his care including helping him into the shower and dressing him. She also did all the shopping, cooking, laundry, and cleaning. She was getting run down and knew she needed assistance.

“They have three children but they are unable to help as one lives in France, one in California, and one is a long-distance truck driver.

“The plan of care was to have an aide come in three times a week to help him shower and help her with household chores. She was concerned about how much it would cost and was reluctant to accept help. I asked if they had long-term care insurance. She said they did and when I explained that the insurance will cover this type of care, I immediately saw the relief in her face. She said, ‘I thought he needed to be much worse off before the insurance would pay.’

As we were getting this plan in place, I received a call. The wife had fallen and hurt her leg, leaving her unable to care for her husband. They now needed to increase the amount of care required. But they were very willing to accept any help they could get because it was covered.

“I have had so many clients that are not willing to get the help they need because they are afraid of spending their money. Those with insurance accept the help and this significantly reduces the stress on the primary caregiver.”

Keep in mind that ordinary health insurance policies and Medicare usually do not pay for long-term care expenses. Medicaid covers some long-term care costs, such as nursing home care and limited in-home care services, but only for a person who meets income and asset limits as well as medical criteria (Family Caregiver Alliance).

LTCi policies can be tailored to cover varying circumstances. Explore your options with Eileen. Sign up for a free consultation (opens in Calendly) to explore your long-term care needs or call 1-800-893-1621.

Got backyard toys? Play it safe this summer

Many people have added more entertainment choices to their homes in recent months. Outdoor options like pools and trampolines can be great fun for a family. But it’s important that you understand some of the realities regarding both safety and insurance coverage.

Captivating to children

Some things are so attractive to children that they can also pose a real and sometimes life-threatening hazard.

The term “attractive nuisance” refers to something that is likely to entice children and could pose a risk of injury. Pools and trampolines are two examples, as well as home playground equipment, tree houses, construction projects, old appliances, or even leftover sand or gravel from landscaping projects.

As a homeowner, you have the burden of taking adequate measures to protect children from these potential hazards. And you may be liable for any injuries that occur even if someone comes on to your property without your knowledge.

Make a (safe) splash

There’s a lot to love about a backyard pool. But like anything else, there is a price tag that comes with it in order to keep everyone safe and make sure you’re financially protected.

Safety tips

- Drowning is silent, not noisy. If you see someone who looks like they’re just treading water, looks glassy-eyed, or has their head tilted back with their mouth open, ask them if they’re all right. If they don’t respond you may have less than 30 seconds to rescue them.

- Always watch your children when they are in or near a pool.

- Have a phone close by at all times.

- Plan out a set of safety instructions and poolside rules and share them with your family, friends, and neighbors.

- You should know how to swim and your children need to learn how to swim.

- Make sure you’re up to date on the latest CPR techniques for adults and children. Visit redcross.org for classes.

Insurance considerations

You need a four-foot or taller fence around the pool with self-closing and self-latching gates. Most insurance companies like Member Benefits require a pool to be four feet from the ground to the top of the pool in order to be covered in the policy. For an in-ground pool, the yard must be fenced in.

Jump carefully

The American Academy of Pediatrics discourages trampoline use due to the risk of bruises, sprains, spinal cord damage, and bone breaks. It reports that the number of trampoline-related pediatric fractures has been increasing each year, from 35.3 per 100,000 in 2008 to 53.0 per 100,000 persons in 2017.

Safety tips

- Allow only one person on at a time, and no children under 6 years of age.

- Do not attempt or allow somersaults.

- Do not use the trampoline without shock-absorbing pads that completely cover its springs hooks and frame. Trampoline enclosures may help prevent injuries from falls.

- Place the trampoline away from structures, trees, and other play areas.

- Do not use a ladder as it can provide unsupervised access to small children.

- Supervise children at all times.

Insurance considerations

Be aware—like many insurers, Member Benefits does not insure homes with trampolines. Consider your potential liability when deciding on whether to have a backyard trampoline.

Be sure you’re covered

Talk to your insurance company about your pool or trampoline so that you clearly understand the specific options, obligations, and coverages in your plan. If you have questions, give us a call at 1-800-279-4030.