Revenge saving: Is it for you?

In the period following the COVID pandemic, there was a trend of “revenge spending” when people were desperate to dine out, travel, etc., because they felt they had missed out during the pandemic. But in more recent times, the concept known as “revenge saving” is having a moment.

Revenge saving is the desire to amass cash against unexpected cost increases during a time of economic uncertainty. It is a time where people choose to be aggressively frugal, sometimes radically paring back their spending to rebuild savings.

A Vanguard study from this past summer found that 71% of Americans said they planned to shift their savings approach to prioritize emergency savings and flexibility. Factors feeding the trend include fluid tariff negotiations, the prospect of continuing high inflation and interest rates, and concerns about geopolitics and social unrest.1

While “revenge saving” is a fresh, catchy phrase, it’s kind of an old concept.

- Gen Z’ers (born 1997 to 2012) have also popularized the term “vibe-based budgeting” this year. They are choosing to adjust their financial habits based on how the economy feels, even if their money situation hasn’t changed.2

- Baby Boomers (born 1946 to 1964) refer to it as “tightening your belt.”

- The Silent Generation (born 1928-1945), who lived through the Great Depression, has always been known for saving money. They saw how quickly it could disappear.

Revenge saving is often driven more by emotions rather than long-term planning. However, the trend does tend to encourage people to focus on their spending and saving habits as well as their financial priorities. And it may be working—according to the Federal Reserve, after a sharp dip from 2020 to 2021, personal savings rates began recovering in 2024.

If you find yourself wanting to rejuvenate your savings for any reason, please let us know. Our financial advisors can work with you to develop a solution that fits you. No revenge or vibes necessary.

Learn more about our financial planning services.

Sources: FMG, Investopedia.

FMG source: Finance.yahoo.com, July 14, 2025. “What is ‘Revenge Saving,’ and should you hop on the trend?

1 CNBC.com, June 27, 2025, ‘Revenge saving’ picks up as consumers brace for economic uncertainty.

2 Finance.yahoo.com, July 15, 2025, ‘Vibe-Based Budgeting’ And ‘Revenge Saving’: How Emotion-Based Habits Could Actually Boost Your Net Worth.

What to leave and what NOT to leave in your car in cold weather

What to have in your car in cold weather

Cold weather is always a good reminder to make sure you have needed emergency items in your car and that your spare tire is in good condition. Here are some things you may want to keep in your vehicle (more info at Ready.gov ):

- Shovel, scraper, and small broom.

- Flashlight and matches.

- Battery powered radio and extra batteries.

- Water and snack food.

- First aid kit with pocket knife.

- Extra hats, socks, mittens, boots, and blankets.

- Tow chain, rope, and booster cables.

- Road salt and sand.

- Emergency flares and fluorescent distress flag.

When the temperatures plunge, have you ever thought about what NOT to have in your car?

Certain items can break, explode, or otherwise suffer negative effects. Consider excluding these items from your car during chilly temperatures:

Medication: Some medications can lose their effectiveness if they freeze. Liquid medications, like insulin, can separate when they thaw, leading to incorrect or ineffective dosages.

Mobile phones/tablets: These items are susceptible to shutting down in cold weather, preventing the lithium-ion batteries from discharging electricity. They may work again when thawed, or there may be condensation inside the unit that short-circuits the battery. Apple and Samsung both recommend operating devices between about 32 and 95 degrees Fahrenheit.

Drinks/food: Soda, beer, and wine will all expand when they freeze, risking an explosion and a sticky mess—or worse, an unwelcome distraction as you’re driving. Food in cans or glass jars react in a similar manner when left in a freezing car.

Musical instruments: Guitars and other wood instruments can suffer serious damage, which may be difficult or impossible to repair. Warm up instruments gradually if you forget them in a cold car.

How we help protect your online yourMONEY™ retirement account

According to the 2025 J.D. Power U.S. Retirement Plan Digital Experience Study, 62% percent of retirement plan website and app users said security was more important than convenience to their overall digital experience—and it is also one of the greatest drivers of customer satisfaction with retirement platform digital tools.

WEA Member Benefits follows industry best practices to protect the privacy and security of your retirement account(s).

- Your account requires multi-factor authentication (MFA) to log in. MFA means that when you sign into your account for the first time on a new device or app, you will need a second verification method to prove who you are (in addition to your username and password).

- Your account is automatically locked after three unsuccessful login attempts in a row.

- A newly opened yourMONEY account will be automatically locked if you haven’t set up your login credentials and MFA after 60 days.

- We require callers to authenticate themselves prior to discussing retirement account information.

- ACH transactions need to complete a real-time account verification that confirms bank account legitimacy.

- IP addresses are limited to within North America, adding additional protection against breaches.

Smart security practices

- Use strong passwords

Create unique, complex passwords for each account.

Avoid using personal information (birthdays, etc.)

Consider using a password manager. - Enable multi-factor authentication (MFA)

Adds an extra layer of protection beyond a password.

Use text, email, or authenticator apps. - Update regularly

Keep banking apps and devices updated.

Install security patches promptly. - Watch for scams

Don’t click suspicious links in emails or texts.

Verify requests for personal or financial info.

Remember, banks rarely ask for sensitive info by email. - Monitor your accounts

Check transactions often.

Set up alerts for unusual activity.

Report suspicious charges immediately.

If you have any questions about the security of your account, call us at 1-800-279-4030.

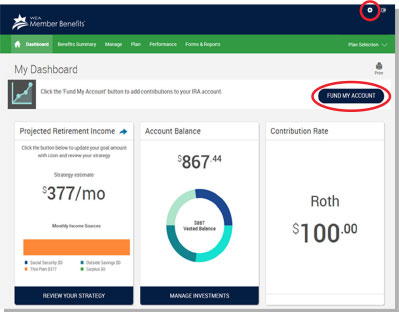

Explore your options in yourMONEY

We hope you are finding the new yourMONEY online tool to manage your retirement account with us beneficial. Here are a few helpful functions we’d like to make sure you’re aware of.

If you have any questions about the new yourMONEY platform, call us at 1-800-279-4030.

DASHBOARD

This is the opening screen in yourMONEY.

- Click on the gear in the top right hand corner to access your personal information and beneficiary designations, and to update your password.

- If you are an IRA account owner, set up a recurring or one-time ACH contribution using the Fund My Account tool.

NAVIGATION BAR

![]()

Explore toolbar options.

- Manage: Manage your investment and review your transactions.

- Forms and Reports: Access your quarterly statement.

- Plan Selection: Toggle between accounts.

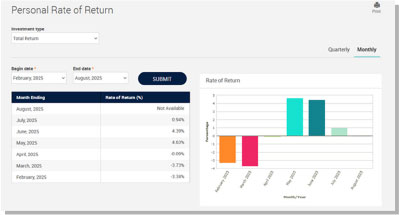

PERSONAL RATE OF RETURN

Review your personal rate of return and investment performance.

Be attentive and alert for deer this fall

Deer crash numbers typically increase in October and November in Wisconsin as more deer move around during peak mating and hunting season. They are most active during the early morning and evening hours.

Statistics

According to the State of Wisconsin Department of Transportation, in Wisconsin one person was killed or injured in an deer crash every 12.2 hours in 2024.

- 17,432 crashes involved deer in Wisconsin in 2024.

- Despite increasing innovation in vehicle safety protocols, there was a peak in 2024 with 9 motorists killed and 707 motorists injured in deer crashes.

- Deer crashes accounted for 14% of all crashes and 2% of all fatalities in 2024.

- Motorcyclists are at a greater risk of injury in a crash involving a deer. There is about a 33% chance that a motorcycle deer crash will result in a fatality or serious injury, compared to less than 0.1% in auto or light truck deer crashes.

How to avoid hitting a deer

- Be sure to use your headlights as daylight transitions to dusk and deer become more difficult to see, especially as daylight saving time ends in November.

- Deer are unpredictable and may freeze or change directions. Drive at a safe speed, eliminate distractions and make sure everyone is buckled up.

- If one deer crosses, watch for more. If you see a deer, honk your horn to urge them to move away from the road.

- If you cannot avoid hitting a deer with your vehicle, brake firmly and stay in your lane. Avoid sudden swerving, which can result in a loss of control and a more serious crash.

What to do after a deer crash

If you do end up hitting a deer, get your vehicle safely off the road, if possible.

- If someone is hurt or the deer is in the active portion of the road, call 911.

- If no one is hurt and your vehicle and deer are off the road, contact local law enforcement.

- Stay buckled up inside your vehicle and wait for help. Getting out of your vehicle and walking along a road is always dangerous.

- Never attempt to move an injured deer.

Source: Wisconsindot.gov

Sharing the road with child pedestrians

Generally speaking, pedestrians have the right-of-way at all intersections. Children are often distracted, unpredictable, difficult to see, and are more likely to take risks. The also may ignore hazards and fail to look both ways when crossing the street. Help keep our children safe by keeping these tips in mind when driving.

- Take extra precautions and slow down in school zones and neighborhoods where children are. Speed limits aren’t suggestions. Stick to the posted limits and always be ready to stop.

- Do not block the crosswalk when stopped at a red light or a stop sign. By doing so pedestrians are forced to walk around your vehicle which puts them in danger.

- Stop or yield the right-of-way to pedestrians crossing the road within a crosswalk or intersection.

- Be alert for children around school buses and bus stops. If red lights are flashing, you must stop at least 20 feet back. Yellow lights mean you may pass, but expect to see children and proceed with caution.

- Follow directions given by a crossing guard, school patrol officer, or special signs.

- Even if you have the legal right-of-way, don’t honk your horn, rush, or scare a pedestrian in front of your car.

- Be cautious when backing out of driveways, school parking lots, or residential streets. Always double-check for kids walking or biking behind your vehicle.

- Stay off your phone. It can wait. One second of distraction is all it takes to cause a tragedy.

Sharing the road with bicyclists

Bicycles, especially children on bikes, are smaller and less visible on the road and so face unique safety challenges. Here are a few things to keep in mind when traveling in areas where adults and children may be present and riding bikes on the road.

- Bicyclists have the same rights and responsibilities on most roadways as drivers do.

- Check your blind spots when turning, opening your car door, or backing out of driveways. Bicyclists are difficult to see behind cars or other obstructions.

- When passing a bicyclist traveling in the same direction as you, slow down and move over if you can do so safely. Wisconsin state law requires motor vehicles to give at least 3 feet when passing a person on a bike. But if you can do it safely, give them same amount of space as you would another vehicle.

- Allow the bicyclist to enter and exit intersections first before making a right or left turn into their path.

- Children riding bikes are inexperienced, don’t use proper judgment, and don’t often know the rules of the road. Exercise caution when sharing the road with young bicyclists.

- Watch for bicyclists turning in front of you. Children don’t often use hand signals or look behind them when turning.

Wisconsin Bike Fed partners with the Wisconsin Department of Transportation and works year round to make roads safer for people on bikes. Learn more about their programs and get resources for their “Share the Road” campaign.

Information from the National Safety Council, Wisconsin Bike Fed.

Sharing the road with school buses

Fall is a great time to remind motorists about sharing the road safely with school buses, bicyclists, and child pedestrians. Let’s start with a few helpful tips to keep in mind when sharing the road with a school bus:

- The school bus is one of the safest vehicles on the road. Less than 1% of all traffic fatalities involve children on school transportation vehicles. However, children are more at risk when approaching or leaving a school bus. The school bus loading and unloading area is the most dangerous for students.

- It is illegal to pass a school bus that is stopped to load or unload children.

- All buses use yellow flashing lights to alert motorists they are about to load or unload children.

- Red lights and an extended stop sign arm signals that the bus is stopped and children are getting on or off. Stop at least 20 feet away, in both directions, from a bus when red warning lights are flashing. (The only exception is if you are traveling on the other side of a divided highway.)

- Do not pass a school bus on the right while it is stopped. Doing so is illegal and could have tragic consequences.

- Keep your distance. Children are most likely to be hit or injured in the area 10 feet around a school bus.

In Wisconsin, when passed illegally, bus drivers are authorized to report violations to law enforcement. In 2024, there were 1,276 traffic convictions for failure to stop for a school bus.

Sources: National Highway Traffic Safety Administration, State of Wisconsin Department of Transportation.

Beware of senior scams

Scammers are increasingly targeting retirees, including Wisconsin public school employees. Using sophisticated tactics like impersonating loved ones, pretending to be Medicare agents, or using fake numbers that look official, they pressure victims into quick decisions that can lead to significant financial loss.

Protect yourself by watching for these common schemes

High-pressure threats

Phrases like “You’ll lose coverage” or “Act now” are designed to scare you.

Requests for gift cards or wire transfers

No legitimate organization will ask for these.

Fake caller ID

Scammers can mimic numbers from trusted sources.

Random tech support or prize calls

If it’s unsolicited, it’s suspicious.

Too-good-to-be-true offers

Guaranteed returns or miracle cures rarely deliver—and often steal.

What you can do

- Don’t answer unknown calls.

- Never send gift cards or wire money.

- Verify before you trust.

To report a scam

Federal Trade Commission

Internet Crime Complaint Center (FBI)

Perception survey 2025

In December 2024, we sent a survey to a random list of 10,000 members. We appreciate all who responded—getting your feedback helps us to best meet your needs. Here is what we learned.

First impressions

What first comes to mind when thinking about WEA Member Benefits is:

- Retirement/retirement planning (25%)

- Customer service (24%)

- Products/services (22%)

“Secure, highly knowledgeable staff, SUPER friendly.”

Reputation

Member Benefits has an exceptional reputation among members. Eighty-two percent felt we have a Very Good or Excellent reputation.

Meets expectations

Fifty-seven percent of members feel Member Benefits Exceeds or Somewhat Exceeds expectations.

Lives up to brand promise

Member opinion on whether Member Benefits lives up to its brand promise remains excellent at 85% replying Often or Always.

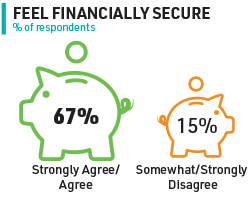

Financial security

The number one personal financial issue for members every year of our survey is preparing for the future (28%), followed by the economy and politics (20%), and paying off debt (13%).

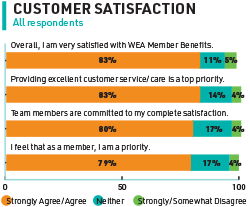

Customer satisfaction

A vast majority of respondents Agree or Strongly Agree that providing excellent customer service is a top priority at Member Benefits.

“WEA Member Benefits is one of the best in the country. Knowledgeable, safe, and staff is available to support and answer questions.”

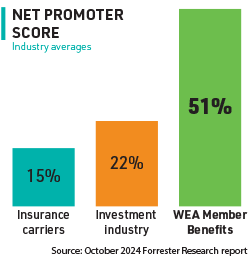

Net Promoter Score

The Net Promoter Score, a measure of likelihood to recommend an organization, is trending up from the past two surveys (51%). A score above 50% is considered excellent. According to a recent report, we have a significantly higher average score than the insurance carrier and investment industries have currently.

Top advice from members

The largest percentage of member advice for David Kijek, President and CEO, focused on service and outreach (31%). Suggestions include more in-person visits to schools and personalized communication, and clearer information about available benefits.

A number of respondents gave us kudos and thanks, such as:

“Thanks for all you do to support teachers, administrators, paras, and staff.”

“Thank you for your service, newsletters, webinars and all the friendly staff I’ve interacted (with). I especially have loved talking to staff that were formerly in public education themselves.”

David Kijek adds, “We’re glad to know how much we’ve continued to provide the excellent customer service you value—that is so important to us. We hold your opinions in high regard and will keep working to make improvements so we can best serve you.”