Learn more about the 403(b) and IRA

Each section has information, tools, and resources to help you understand what you need to consider when choosing a retirement plan.

Learn about the Roth, investment strategy, risk tolerance, choosing beneficiaries, and much more.

Protecting a legacy: Participant level protections

Effective January 1, 2023, the Prudential Guaranteed Investment was renamed to the Guaranteed Stable Investment. The Prudential Retirement Insurance & Annuity Company (PRIAC) was purchased by Empower Annuity Insurance Company (EAIC). As you read this article, any reference to PRIAC should be replaced with EAIC. Any reference to Prudential should be replaced by Empower.

A detailed evaluation of the Guaranteed Investment and our partnership with Prudential Retirement Insurance and Annuity Company (PRIAC) in their role as manager of the account wrapped up last fall. In the end, the team found that under the current market conditions, PRIAC still provides one of the strongest guarantees and crediting rates in the marketplace.

New participant level protections

Continuing with PRIAC brought the addition of participant level protections (PLP) to the Prudential Guaranteed Investment Account (PGI)—403(b) and IRA. These protections kick in to preserve the guarantee of the fund and are state of the art in terms of plan participant protections. The PLP puts controls in place that effectively restrict withdrawals if certain economic conditions exist (simultaneously) that would jeopardize the safety of the fund and those participating in it. The PLP cannot be activated until July 1, 2018.

Benefit responsive withdrawals are not impacted

It’s important to note that the fund will still be benefit responsive, meaning:

- 403(b) participants will STILL be able to receive their PGI balance upon retirement, disability, death, termination of employment, in-service withdrawals after age 59½, and as required minimum distributions (RMDs) at age 73 (effective January 1, 2023) (age 70½ if reached prior to January 1, 2020).

- IRA participants will STILL be able to receive their PGI balance upon death and as RMDs at age 73 (effective January 1, 2023) (age 70½ if reached prior to January 1, 2020).

What triggers the PLP?

Certain transfers or withdrawals may be limited to 20% of a member’s balance per calendar year if certain market conditions exist. There are three triggers that all need to exist at the same time before the PLP kicks in:

FIRST…

The yield on one or more specified benchmarks is greater than or equal to the crediting rate of the PGI.

SECOND…

The total cash going out from the PGI exceeds a specified threshold. Basically, more cash is going out than coming in.

THIRD…

The market value of the underlying investments supporting the PGI is less than or equal to the PGI book value. (The book value of an asset is its original purchase cost, and market value is the price that could be obtained by selling an asset on a competitive, open market.

Until all these conditions exist at the same time, the PLP is not in effect and participants can freely withdraw/transfer PGI funds in either program.

If all the conditions exist at the same time, the PLP is activated and is in effect for the remainder of the calendar year.

What happens once the PLP is triggered?

Once the PLP is activated, the amount of PGI withdrawals and/or transfers for the year are measured against the participant’s beginning of the year PGI balance. (For 2018, however, the account balance will be as of February 1.)

If the withdrawal/transfer amount is greater than 20% of the participant’s first of the year account balance, a participant will only be able to make transfers and withdrawals that are benefit responsive for the remainder of the year. The 20% PLP limit is tracked separately for the 403(b) and IRA PGI accounts.

| Transaction type | Counts toward PLP limit | Restricted after limit is met |

|---|---|---|

| Benefit responsive withdrawals* | Yes | No |

| Transfers between PGI 403(b) and IRA | No | No |

| Transfers from PGI to another investment inside or outside of the WEA 403(b) and IRA | Yes | Yes |

| Auto-rebalance or initial enrollment in model portfolio resulting in transfer out of PGI | Yes | No |

| All other non-benefit- responsive transfers or withdrawals from PGI | Yes | Yes |

| *Benefit responsive withdrawals are not the same for 403(b) and IRA accounts as noted in the article. | ||

While the PLP may feel restrictive, it is important for the protection of members and the longevity of the fund. Other providers often impose more restrictive PLP terms.

*Interest is compounded daily to produce a yield net of Empower’s administrative fee of 0.60%. Empower Annuity Insurance Company (EAIC) is compensated in connection with this product by deducting an amount for investment expenses and risk from the investment experience of certain assets held in EAIC’s general account. For more information, go to weabenefits.com/empower.

Auto insurance basics

https://www.youtube.com/watch?v=g-Kv4a08aJE

Tune in to this quick video from the Insurance Information Institute to get an overview about the different types of auto insurance, get helpful tips on responsible driving, and learn how to reduce your auto rates by getting the right coverage for your needs.

Then contact Member Benefits. We can help you become a better insurance consumer so you can decide on the appropriate coverage that works you.

Call us at 1-800-279-4030 or set up a personal consultation at a time convenient to you at weabenefits.com/consults.

(Video source: iii.org)

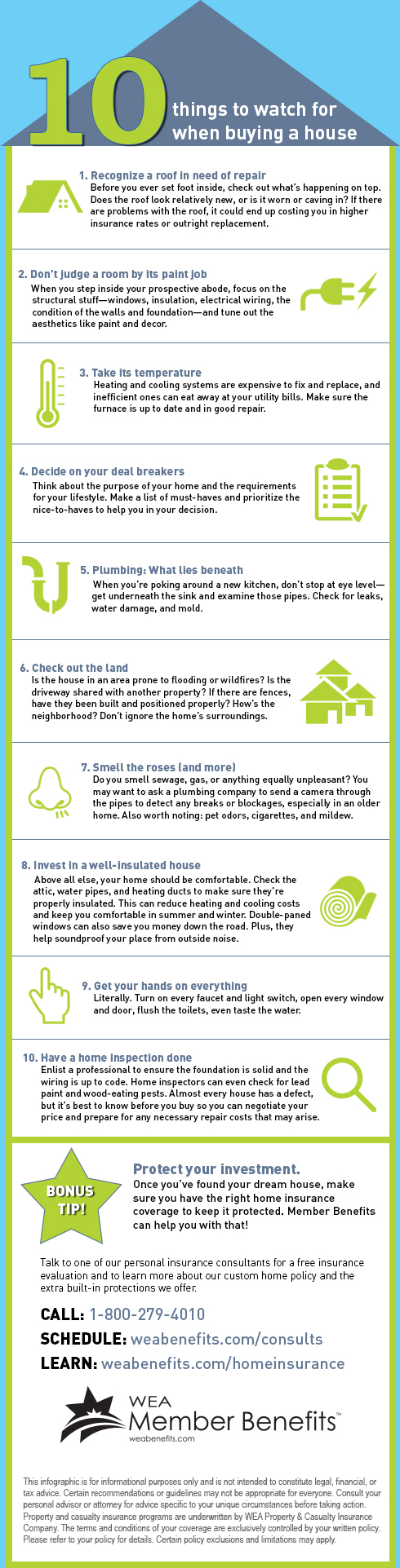

10 things to watch for when buying a house

10 things to watch for when buying a house infographic continued from “Tips for first-time home buyers” article.

Tips for first-time home buyers

The housing bubble collapse and the recession shattered the long-held belief that you can’t go wrong investing in a home. Ten years later, foreclosures and housing values have generally returned to more traditional levels. However, what hasn’t returned is the unquestioned desire to own a home.

An important takeaway from the recession is that homeownership is not something to go into without some serious thought and preparation. It’s not for everyone and there may be good reasons not to join the rolls of homeownership. Before you take the plunge, consider:

The length of time you plan to stay in the house. Buying a home can be a good investment, but there is risk in taking on a mortgage. And, as the recession proved out for lots of people, investing in property is not a sure thing. There is a general rule that those in the real estate industry use as a guideline—if you don’t plan to stay in the home for at least five years, it may not be a wise financial decision. The five-year rule makes sense because:

- When you take out a 15- or 30-year mortgage, the vast majority of your monthly mortgage payment for the first few years of the loan goes toward interest charges. That means you won’t make much progress in building equity during those early years. And building equity is the primary reason for buying a house in the first place.

- The closing costs associated with a home purchase include fees for mortgage origination, title insurance, inspections, appraisals, legal costs, etc. They usually run about 3% to 6% of the price of the home. So it’s costly to frequently trade up to a new home.

Mortgage debt is considered “good” debt, but there is still a certain amount of risk (and commitment) involved. A lease gives you more freedom to move and the flexibility to adjust your housing expenses based on your financial situation.

Beyond the mortgage

Go into homeownership with your eyes wide open. Owning your own place has costs beyond the mortgage. Make sure to budget for these additional expenses.

- Property taxes. Property taxes support schools, pay for trash removal, and generally support the community you live in. They are necessary. They will be different depending on where you live and are assessed annually. The amount of your taxes may also vary each year depending on the assessed value of your home, the mil rate used by your municipality, and other projects that your community may be undertaking. If you want to get a general idea of what your annual taxes will be, divide that number by 12 and set that amount aside each month in a special “taxes” savings account to ensure you have the money available when the tax bill comes. Or, put it in escrow as part of your total monthly loan payment.

- Maintenance (inside and out). Whether it’s new paint or flooring, remodeling a bathroom to your liking, or must-do’s like a new furnace, roof, or hot water heater, maintaining a home can be costly. Because it’s such a significant investment, you need to keep your property up for resale purposes. Maintenance may also require some basic tools such as a lawn mower, ladder, or dehumidifier, which you wouldn’t necessarily need as a renter.

- Utilities. Be prepared to pay water, electric, and heating costs. Ask to see the current homeowner’s costs for the last year to get an idea of what you may need to budget for. Don’t forget to factor in cable or internet service.

- Insurance. Your home may be the biggest investment you ever make. Protect yourself from financial loss in the event your home is damaged or destroyed with proper insurance. The cost of home insurance is dependent on many factors, including how much coverage you purchase, your deductible, distance to a fire station, etc. Don’t skimp on coverage to save money. You’ll want to have enough coverage to rebuild your home in the event of a total loss. Be prepared to purchase private mortgage insurance as well if you have less than 20% of the purchase price for a down payment. This insurance may be required and will apply until you have built up 20% equity in your home.

- Time. The biggest cost of being a homeowner is time. Cleaning, yard work, shoveling snow, DIY projects—there is always something needing to be done. Lots of people actually enjoy maintaining their home. They get a sense of satisfaction from it and it can be something of a badge of honor. But it might not be how you want to spend your time. Consider the time commitment of owning a home before you buy.

- Your goals. Looking at your personal and financial goals will also help you decide whether owning a home is right for you right now. Taking a big step like buying a home without accounting for it in your plan could throw you off course.

Continue with infographic, “10 things to watch for when buying a house.”

Home insurance basics

https://www.youtube.com/watch?time_continue=1&v=PUZSIahxq-g

The Insurance Information Institute has a great little video that explains what most policies cover (and don’t cover). Watch and learn about liability, additional living expenses, and other coverages in your insurance policy.

Then contact Member Benefits. We can help you become a better insurance consumer so you can decide on the appropriate coverage that works you.

Call us at 1-800-279-4030 or set up a personal consultation at a time convenient to you at weabenefits.com/consults.

(Video source: iii.org)

Before you choose a retirement savings account

Before you choose an account, check off these questions:

- What fees will you be paying? Do you know all the hidden costs?

- What features do you think are worth paying for?

- Do your homework: How is the company rated? What are other people’s experiences?

- Do the math: What is the totality of all costs over time?

- What is the liquidity of the accounts, do you have flexibility?

- Get help, you have us! Call 1-800-279-4030 or send an email to retirement@weabenefits.com.

Topic continued from “3 things you need to know to navigate fees in your retirement savings account” article.

Do your accounts have the right beneficiaries?

The beneficiary designations associated with your retirement account(s) take precedence over your will.

- To view your current beneficiary designations through Member Benefits, log into the yourMONEY account portal.

- Beneficiary change forms can also be downloaded from our retirement forms page.

Want more information about choosing beneficiaries? Read our online brochure, Choosing Beneficiaries for Your Retirement Account.

Protecting a legacy: The update

Effective January 1, 2023, the Prudential Guaranteed Investment was renamed to the Guaranteed Stable Investment. The Prudential Retirement Insurance & Annuity Company (PRIAC) was purchased by Empower Annuity Insurance Company (EAIC). As you read this article, any reference to PRIAC should be replaced with EAIC. Any reference to Prudential should be replaced by Empower.

In the Summer 2017 issue of your$, we shared that we were in the midst of a detailed evaluation of the Guaranteed Investment and our partnership with Prudential Retirement Insurance and Annuity Company (PRIAC) in their role as manager of the account.

In that article, “Protecting a Legacy,” consultants Mike Driscoll and Jim King—both with a vast amount of knowledge in the stable value investment realm and firsthand experience with the Guaranteed Investment—and Member Benefits staff, explained the objectives of the project, noted possible changes, and promised an update in January…so here it is.

Below, Mike, Jim, and Member Benefits respond to questions about the evaluation results and what it means for members like you.

Why do an evaluation of this scale and what did it entail?

Member Benefits: Just as we monitor our mutual fund offerings to make sure they continue to meet our standards, we monitor the Guaranteed Investment. We also regularly evaluate PRIAC in their role as manager of the account to ensure the best interests of our participants are being served. This evaluation was more comprehensive. It included sending out requests for proposals (RFP) to over 30 companies to identify options and to determine if the program as offerednow is still competitive.

Mike: The RFP allowed us to evaluate PRIAC—their fees and crediting rate—and compare it to marketplace alternatives.

What were the results of the RFP?

Mike: The team looked at the entire stable value marketplace for traditional providers that offer stable value products to 403(b) plans. There were five organizations we felt could be good partners for Member Benefits and the membership.

Jim: The overarching goal was to see if there was a better way to offer the stable value fund, whether that meant to change to a new provider or to diversify the fund by adding another stable value manager or guarantor. It took about 10 months to complete the analysis.

Mike: Under the current market conditions, PRIAC still provides one of the strongest guarantees and crediting rates in the marketplace, and we decided not to diversify the portfolio at this time.

In the last article, we noted that some companies being vetted were rated higher than PRIAC. We also discussed PRIAC’s designation as a Systemically Important Financial Institution (SIFI) by the Financial Stability Oversight Council. How did that play into the outcome?

Jim: PRIAC remains very strong in the marketplace and they carry strong financial strength ratings that are the basis of the guarantee they are able to offer. They are a leader in stable value and still represent a very solid investment and partner.

Mike: Some firms were rated slightly higher, but there is no concern that PRIAC is going to run into trouble. Although PRIAC is a SIFI (“too big to fail”), the designation did not play a significant role in our decision.

The benefits of diversification in the Guaranteed Investment account were discussed at length in July. Why was it decided not to diversify?

Jim: The analysis the team went through was very much like a cost-benefit analysis. We determined that diversification would be a desired concept but not at any cost. We concluded that the cost of diversification, meaning the impact on the crediting rate, did not justify the additional benefit of diversification. This is because we did not find another provider that could offer a better rate and contract than PRIAC at this time. Introducing another guarantor would have negatively impacted the crediting rate.

Mike: We are conscious of the fact that diversification is important, but we won’t do it if it will significantly impair what the membership has today. We won’t take a step back just to diversify.

Member Benefits: Current market conditions are not conducive to diversification. The benefit of the contract with PRIAC is that it’s one of the most flexible contracts in terms of the ability to diversify when market conditions are right. That means the cost of diversification could be offset by the benefits of diversification in a higher interest rate environment. We will be monitoring market conditions and the investment rate environment, and if it appears there is a window of time when it makes sense to diversify, we will reevaluate it.

“This program is so unique and important to the membership, we will do whatever we need to do to ensure the viability of this program for long-term investors in the future.”

You predicted in July that the rate may go lower before stabilizing. The 2018 rate is 3.15%—0.35% lower than 2017. So you were right. What needs to happen for that rate to turn around?

Jim: Market interest rates would have to increase in order for the crediting rate to go up, but it would rise at a slower rate than the market. Basically, the crediting rate of stable value funds lag the market. So when interest rates are increasing, stable value fund rates should increase, but more slowly. The same is true when interest rates are decreasing. Stable value fund rates should fall but more slowly.

A few members have said they can get a higher rate someplace else. That contradicts what you have said about what’s available. How do you explain that?

Mike: There may be stable value funds that provide a slightly higher crediting rate to members—but that may come at a significant cost. Certain stable value funds tie up your money for up to 10 years. So you are giving up significant liquidity to get that rate. Members may not realize that while they have the freedom to move their money from Member Benefits, they may not have that freedom with another company.

Member Benefits: We put a high value on liquidity for members. We do not have a surrender period that ties up your money for extended periods of time—typically 6‒10 years with other companies.

Jim: Here’s an example. Let’s say a member moves to an account for the 4% guarantee, but it has a 10-year surrender period. They will get 4% even if the market drops, but if the market goes up, they will miss out on the ability to earn a higher rate for 10 years because of the surrender period.

Withdrawal restrictions were another anticipated change. What does that look like?

Jim: Participant level protections (PLP) have been developed that will increase the safety of members who are in the fund. Going forward, the fund will always be benefit responsive, meaning that members will always be able to receive their guaranteed amount upon retirement, disability, death, termination of employment, and as required minimum distributions at age 70½. Members will be able to withdraw under those conditions at all times—no exceptions. Certain transfers or withdrawals may be limited to 20% of a member’s balance per calendar year if certain severe market conditions exist. These protections kick in to preserve the guarantee of the fund and are state of the art in terms of 403(b) plan participant protections.

Mike: There are three triggers before the PLP kicks in. First, certain specified benchmark yields would need to increase above the crediting rate of the fund. Second, the cash flow of the fund would have to be negative, meaning that the fund is being subject to withdrawal requests that exceed the contribution level received during that calendar year. And third, the market value of the underlying investments supporting the fund is less than the contract value. If these three things happen at the same time, then and only then will a participant be limited in moving money out at the 20% per year limitation.

Member Benefits: Other providers often impose more restrictive PLP terms. The PLP cannot be triggered before July 1, 2018 and is based on the account balance at the beginning of the year (February 1 for 2018).

Based on your experience and knowledge of this account and stable value funds, how do you feel about the results of this evaluation?

Mike: Members should feel good and be proud of the work the team did because we are looking out for their best interest and striving to have the best investment programs available for Wisconsin public school employees. The team is open to making changes that will improve the program. However, we will not make a change if it is detrimental to the member. We have stayed true to the principles of why the program was put together: for the protection and safety of principal and to get a reasonable rate of return.

Jim: I feel very good the process was conducted with the benefit of members being paramount and that the current contract with PRIAC is a state-of-the-art 403(b) contract that does not exist elsewhere. The process was a complete review of what is available in terms of best practices in the stable value world. It set a foundation for Member Benefits to move very quickly if market conditions are supportive of diversification, meaning we have done all the legwork related to the due diligence process and completely vetted the marketplace.

What are the next steps?

Jim: We will be diligent in monitoring market conditions and we are ready, willing, and able to act if conditions are appropriate.

Mike: The team does not view this as the end of the process but rather as part of their ongoing due diligence.

Member Benefits: It’s our responsibility to protect the members and their investments. This program is so unique and important to the membership, we will do whatever we need to do to ensure the viability of this program for long-term investors in the future.

If you missed the previous article…

- WEA TSA Trust rolled out a Guaranteed Investment account (which is a stable value fund) in 1978.

- The purpose of the account was—and continues to be—to provide members with a safe place to put their savings, the ability to earn a reasonable rate, and a guarantee on their money.

- Today, about 46,000 participants have nearly $2.4 billion worth of assets in the account.

- Prudential Retirement Insurance and Annuity Company (PRIAC) currently holds and manages the account.

- It’s a unique product that can’t be duplicated in the marketplace.

- Member Benefits began the evaluation of the Prudential Guaranteed Investment in the fall of 2016.

*Interest is compounded daily to produce a yield net of Empower’s administrative fee of 0.60%. Empower Annuity Insurance Company (EAIC) is compensated in connection with this product by deducting an amount for investment expenses and risk from the investment experience of certain assets held in EAIC’s general account. For more information, go to weabenefits.com/empower.

Protecting a legacy

Effective January 1, 2023, the Prudential Guaranteed Investment was renamed to the Guaranteed Stable Investment. The Prudential Retirement Insurance & Annuity Company (PRIAC) was purchased by Empower Annuity Insurance Company (EAIC). As you read this article, any reference to PRIAC should be replaced with EAIC. Any reference to Prudential should be replaced by Empower.

June 2017

In 1978, the WEA TSA Trust rolled out a Guaranteed Investment account to Wisconsin public school employees as its first 403(b) investment opportunity. Today, approximately 46,000 participants have nearly $2.4 billion worth of assets in the account currently held and managed by Prudential Retirement Insurance and Annuity Company (PRIAC).

It’s kind of a big deal.

Just as Member Benefits monitors our mutual fund investments to make sure they continue to meet our standards, we also monitor the Guaranteed Investment and evaluate PRIAC in their role as manager of the account to ensure the best interests of our participants are being served.

Experts on board

Helping with the due diligence process are Mike Driscoll and Jim King. Both have a vast amount of knowledge in the financial industry as well as personal work experience with the Guaranteed Investment.

Mike, now a consultant, has worked with retirement plans for over 30 years. “In 1987, I worked at CIGNA and was involved when the assets in the Guaranteed Investment were moved to CIGNA from UNUM.”

As Mike indicates, the guaranteed account has not always been with PRIAC. PRIAC actually inherited the account after they purchased the CIGNA retirement business in 2004. Member Benefits has been with PRIAC ever since.

Jim spent 17 years in portfolio management with Merrill Lynch, including stable value (SV) funds (which is essentially what the Guaranteed Investment account is.) He then spent 15 years with PRIAC specializing in SV funds before starting his own SV consulting company. “At PRIAC, I was partly responsible for the relationship with Member Benefits and managed the Guaranteed Investment for over five years, so I know the fund very well. It’s one of the best stable value funds in the country,” he says.

Doing our due diligence

Member Benefits is currently evaluating the Guaranteed Investment. A Request for Proposal (RFP) was drafted and sent to over 30 companies to see what options were available. In the end, seven companies expressed interest and five gave a formal response. Those five responses are currently under consideration.

The RFP will help us determine if the program as offered today is still competitive in the marketplace. Member Benefits will be looking at firms that can provide a similar program and evaluating their interest rates, fees for service, and the types of portfolios they invest in. We will also do our normal due diligence, including financial strength ratings. In the end, we’ll want to answer this core question: What is in the best interest of our members?

One of a kind

One thing is clear: The Guaranteed Investment is one of a kind. Its uniqueness started at its inception with the philosophy on which the program was built.

When the account was moved to CIGNA, Mike recalls, “There was a strong belief that the money in the Guaranteed Investment Account was to be protected. The creation of the WEA TSA Trust 403(b) program wasn’t meant for people to chase equity market returns. This was for safe keeping. And that’s why only the Guaranteed Investment was offered in the beginning, and members were not offered an equity fund option early on.”

The founders of our 403(b) program felt the best way for members to get to retirement and have enough saved to support themselves was by putting their money in a safe place, earning a reasonable rate of return, and having a guarantee against loss. Those three things were important then and they remain a priority for Member Benefits today.

A long legacy

“There are many competitors in the marketplace that have been trying to figure out how Member Benefits has been able to be so successful with this program and offer the guarantee and low fees. It’s because this legacy product has worked really, really well for members over time and it has been impossible for anyone to duplicate,” says Jim.

What makes it so difficult to copy? In part, the success of this program was the timing of when it came together. In 1978, the economy looked very different. Interest and inflation rates were on the rise—both were north of 12%—and, according to Mike, the timing couldn’t have been better to establish a SV fund. “The high interest rates and inflation rates at that time turned out to be a real plus, creating a big tailwind of higher returns supporting the program while the interest rate markets steadily declined over the following 30 years. This is one of the main reasons why other organizations can’t replicate it.”

Mike goes on to explain that the tailwind was created by CIGNA/PRIAC making loans and buying bonds—5-, 10-, 20-year loans or bonds—at 10% or more. “These long-term investments continued to pay back at the high rate over however many years, even as interest rates in general fell. This allowed the credited rates in the Guaranteed Investment Account to remain higher for a longer period of time, and members were rewarded with higher than current market returns.”

However, while the rate was slow to come down and meet the market, rates are also slow to rise when the market goes up. “Stable value funds lag the market, regardless of which direction the market is going,” he adds.

“It’s one of the most seasoned funds in the country.” — Jim King

The Guarantee is the key

A SV fund is comprised of two parts: 1) a portfolio, and 2) a guarantee. The guarantee is on the participant’s principal and net credited interest. In other words, investors will never receive less than what they have contributed plus the accumulated interest credited on those contributions, even though the price of the underlying securities (the bonds and funds in the investment) may go down.

The value of SV funds proved out during the 2008 financial crisis when the stock market tanked. Portfolios that held SV fund investments fared better because of the guarantee. “A stable value fund serves as an anchor,” says Jim. “In a volatile market, it maintains its value and is a buffer for the entire portfolio. Because the Guaranteed Investment has been around since 1978, it’s one of the most seasoned funds in the country.”

The rising cost of a guarantee

To ensure the safety of participant assets, PRIAC is required to hold reserves equal to the assets in the Guaranteed Investment. Jim explains that while the guarantee of SV funds worked as intended in the 2008 crisis, the fact that bond prices decreased significantly put SV managers at a greater risk for loss because the guarantee became much more expensive. “In fact, the price of guarantees in the marketplace almost tripled,” he says.

The increased cost of the guarantee presents a special challenge for PRIAC and the Guaranteed Investment.

Mike adds that since the crisis, actuaries and regulators have taken more of a microscopic look at the risks of SV from the guarantor side. The Financial Stability Oversight Council created by the Feds under Dodd-Frank developed the Systemically Important Financial Institution (SIFI) designation to label companies whose collapse would pose a serious risk to the economy. This is the “too big to fail” list.

In 2013, PRIAC was one of four non-bank companies put on the SIFI list. SIFIs abide by “enhanced” rules that are tougher than the ones that apply to their smaller, less-complex peers. Higher capital requirements effectively limit how much SIFIs can borrow, and can crimp profitability. Defenders of the SIFI process say those stricter regulations are justified because SIFIs pose an outsized risk to the stability of the broader economy.

“For PRIAC, this status is costly and forcing change. The Guaranteed Investment will likely not be immune to these changes,” says Jim.

Diversifying could help

According to Jim, the sheer size of the fund increases the risk for PRIAC, as well as for members.

Why? With PRIAC, there is a single provider of the guarantee. Essentially, we have all our $2.4 billion SV fund eggs in one basket. It’s been this way for 39 years.

However, every fund evaluation poses this question: Is this prudent? In 2012, we examined PRIAC’s products, fees, services, financial strength, financial position, and client management among other things, and compared them to those of other major stable value providers. Mike was a member of the evaluation team, and says the answer to that question in 2012 was yes. “We concluded the relationship with PRIAC was still in the best interest of members. They were still strong and stable and the program continued to be better than anything else available, even with contract changes imposed by PRIAC at the time.”

The evaluation in progress will again have to answer these questions: Is PRIAC the best partner today? Should we continue with a single creditor program, or do we need to start to look at diversifying—spreading the account and the risk to one or more additional firms? If doing so would strengthen the guarantee, that would definitely be a plus.

The Prudential Guaranteed Investment account is a long-term savings vehicle that assumes the role of a fixed income or bond investment in your asset allocation mix. Learn more.

Vetting potential partners

“We use ratings issued by Standard & Poor’s, Moody’s, and Fitch,” explains Mike. “Moody’s rates PRIAC as A1, the fifth highest of 10 investment grade ratings. That’s a good rating, but there are ratings above that, like Aa and Aaa. Some of the interested companies who responded to the RFP are Aaa, which indicates that they are in a slightly stronger financial position today than PRIAC.” Financial strength is a must, but there are other critical considerations as mentioned earlier.

Regardless of who we decide to partner with, at the end of the day, it’s important that members know we have done everything we can to choose a strong financial institution(s) to honor the guarantee.

Predicting the future

After nearly 30 years of declining interest rates, we are in an economic environment in which rates are expected to rise. “In fact,” Jim says, “this last week (June 14, 2017), the Federal Reserve announced a quarter-point interest rate hike.” Interest rate changes are among the most significant factors affecting bond return. When interest rates rise—bond prices generally fall. And that puts the SV fund managers at higher risk to sustain losses.

“In regard to the Guaranteed rate,” Mike suggests, “members will likely see interest rates in the program fall a little further before stabilizing regardless of what changes come from the evaluation. We will also see the impact from the increased cost of a guarantee.

“Further, members currently have the ability to move money freely in and out of the program, but it would not be unreasonable to expect some parameters set around how much can be moved out of an account in a given year.”

Mike explains that the withdrawal parameter may be necessary to protect the account for long-term investment. A large-scale withdrawal from an SV fund could impose a significant adverse impact on all of the remaining investors and potentially result in losses for the SV fund manager.

Most other SV funds do not allow the plans or the participants to immediately receive the book value of the investment, which is contributions plus interest earnings, if the fair market value of the investment is less.

It’s Member Benefits’ responsibility to protect the members and their investment, as well as ensure the viability of this program for long-term investors in the future.

“This program has good bones.” — Member Benefits staff

Looking forward

The Guaranteed Investment may look different after the evaluation is complete and decisions have been made, but both Mike and Jim agree that it will still fulfill the original purpose and be in the best interest of members. That purpose includes:

- Safety (low risk).

- Earning a reasonable rate.

- Having a Guarantee.

As Member Benefits says, this program has good bones. The fact that it was carefully designed for the benefit of our public school employees is precisely why it has succeeded. We’ve never lost sight of why it was created.

Some things to expect as we move forward include:

- The crediting rate may go lower before stabilizing.

- Flexibility for moving money may change.

- We are working to maintain the unique characteristics of the program that set it apart from other SV funds, including offering a higher level of protection in different economic environments.

- We are considering providers that maintain transparency regarding fees and strong financial ratings.

At the end of the day, we want to work with a company or companies that have similar core values to our own and can contribute to the financial security of Wisconsin public school employees. We are working hard to do just that.

Interest is compounded daily to produce a yield net of Empower’s administrative fee of 0.60%. Empower Annuity Insurance Company (EAIC) is compensated in connection with this product by deducting an amount for investment expenses and risk from the investment experience of certain assets held in EAIC’s general account. For more information, go to weabenefits.com/empower.

Meet our consultants

Mike Driscoll, Managing Director of Sheridan Road

Mike began his institutional retirement plan career in 1980. He spent nearly 17 years with CIGNA Retirement & Investment Services prior to the sale of CIGNA’s retirement business to Prudential Financial in 2004. He was also involved with transitioning Guaranteed Investment assets from UNUM to CIGNA from 1987–1988.

Mike has earned and maintains the Accredited Investment Fiduciary designation. He is a past President of the Board of Directors of the Greater Milwaukee Employee Benefits Council.

He also has a personal connection to and interest in Wisconsin public schools. “My wife Janet was a teacher. She taught in the Cedarburg School District.”

Jim King, Founder and CEO of King Stable Value

Jim serves as general account investment portfolio specialist and spent 15 years with Prudential Financial. For more than five of those years, he managed the Guaranteed Investment for the WEA TSA Trust and WEA Member Benefit Trust. “I know the guaranteed fund very well,” he says. “It’s one of the best stable value funds in the country.”

Jim serves as general account investment portfolio specialist and spent 15 years with Prudential Financial. For more than five of those years, he managed the Guaranteed Investment for the WEA TSA Trust and WEA Member Benefit Trust. “I know the guaranteed fund very well,” he says. “It’s one of the best stable value funds in the country.”

Jim is also a past Chairman of the Board for the Stable Value Investment Association.