Good things come to those who START NOW!

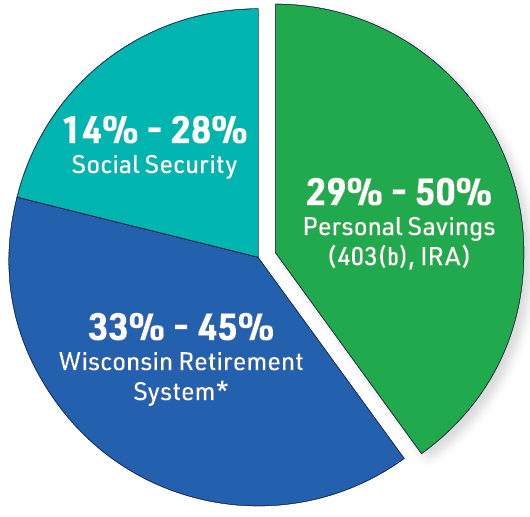

WRS and Social Security alone may not provide the financial security you need for a comfortable retirement. Many Wisconsin public school employees will need to cover 29% – 50% of their retirement income with personal savings to maintain their lifestyle, but a 403(b) or IRA can help bridge the difference — AND time is on your side!

Thanks to compound interest, small, consistent contributions can grow significantly over time as your interest earns interest—creating a powerful snowball effect. This makes early saving one of the best financial decisions you can make!

Ready to get started?

Enroll in a 403(b) or IRA today! Still need some convincing? Keep scrolling to learn about our friends Jack and Jill and how they saw the power of compound interest in action.

*Sources of retirement income for most Wisconsin public school employees. *The percentage of salary replaced is tied to how many years one works in state service. The 33%–45% figure assumes 25–33 years of WRS service and depends on individual circumstances. WRS covers most public employees of the State of Wisconsin as well as local government employees who elect to participate.

Meet Jack and Jill

Jill understands the importance of starting early, so at age 22, she begins saving for her future. She contributes $50 per pay period (24 times a year), totaling $12,000 over 10 years. After that, she stops contributing, but her investment continues to grow, reaching $103,530 by age 55.

Jack, on the other hand, waits 10 years before starting to save. At 32, he realizes the importance of saving for retirement and begins contributing the same $50 per pay period. Over 24 years, he contributes a total of $28,800. Despite contributing more, his account grows to only $80,373—falling short of Jill’s balance.

Jack’s delay in getting started is the reason he doesn’t catch up with Jill—showing the true power of compound interest.

Check out what would happen if Jill continued saving $50 per pay period until age 55.

Your actual situation may be different from the value shown here. This example uses a projected earning rate of 7.5% for illustrative purposes only. No guarantees are expressed or implied. Results will vary depending upon the actual rate used in the calculation. Over time, the results of any investment will fluctuate and are not guaranteed.

Ready to take control of your financial future?

Here’s what you need to know about our IRA and 403(b) options to help you get started.

IRA

An Individual Retirement Account (IRA).

TRADITIONAL (you pay taxes later)

Contributions may be tax-deductible up to a certain amount each year, and your investments grow tax-deferred.* You pay taxes on your contributions and earnings when you make withdrawals in retirement.

ROTH (you pay taxes now)

You can make after-tax contributions, up to a

certain amount each year. Your investments will grow tax-free, and you won’t pay income taxes on qualified withdrawals. Income limits may apply.

*Deductible contributions reduce your taxable income and defer taxes until you withdraw the money. However, not everyone is able to deduct Traditional IRA contributions. Please consult with a tax advisor to determine the extent of your ability to deduct your contributions.

403(b)

Employer-sponsored plan (similar to a 401(k) in the private sector). Also referred to as a tax-sheltered annuity (TSA).

BEFORE-TAX (you pay taxes later)

Contributions are made through payroll deduction on a pre-tax basis, allowing you to defer taxes until the money is withdrawn in retirement.

ROTH (you pay taxes now)

Contributions are made through payroll deduction and are after-tax, meaning you pay taxes now on your contributions, but all qualified withdrawals, including earnings, are tax-free.

Why choose us?

Low Costs: Keep more of your money working for you with low administrative costs and no-load mutual funds. No transfer fees or withdrawal penalties.

Member-Focused: Profits are reinvested to benefit participants. We serve public education employees exclusively, with no commissions or shareholders.

Flexible Investments: Want your investments managed for you? No problem, that’s included at no extra charge. Prefer to build your own portfolio? We have you covered—we offer a lineup of investment choices that are selected and monitored by a professional investment committee.

Personalized Service: Talk to a live consultant for personalized guidance. Phone consultations are available at your convenience.

24/7 Access: Manage your account anytime, anywhere.

Ready to enroll?

Enroll in an IRA or 403(b) today and take advantage of low costs, flexible investment options, and personalized support. Take a step toward your financial security.

Prefer to talk to someone first?

Book a FREE 30-minute consultation with one of our Member Benefits Consultants—retired educators who truly understand the unique financial challenges of public school employees.

Created by educators

WEA Member Benefits

Over 50 years ago, we were created by Wisconsin educators for Wisconsin educators. No other financial organization can say this. Explore our unique programs and services.