IRA

Individual Retirement Accounts (IRAs) are a great way to save for your future

Available in Wisconsin, Arizona, Colorado, Florida, Illinois, Indiana, Iowa, Massachusetts, Michigan, Minnesota, North Carolina, Pennsylvania, South Dakota, and Texas.

Individual Retirement Accounts (IRAs) are a great option for increasing your retirement savings and taking advantage of tax benefits. We offer both Traditional and after-tax (Roth) IRA options.

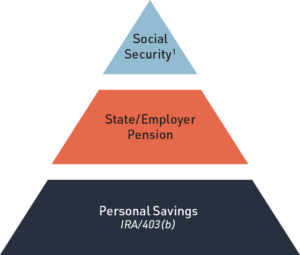

State or employer pension funds and Social Security may not be enough to fund your retirement. Most individuals will need three or more sources of retirement income to maintain their lifestyle in retirement.

Building a strong foundation of personal savings is a key step in the financial journey. How will you build your foundation?

Individual Retirement Accounts (IRAs) are a great way to save for your future, increase your retirement savings and take advantage of tax benefits. We offer both Traditional and after-tax (Roth) IRA options.

State or employer pension funds and Social Security may not be enough to fund your retirement. Most individuals will need three or more sources of retirement income to maintain their lifestyle in retirement.

Building a strong foundation of personal savings is a key step in the financial journey. How will you build your foundation?

1Social Security may not apply to all public employees in all states.

Why is our National IRA right for YOU?

- 20+ high-quality, low-cost investment options, chosen and regularly monitored by a professional investment committee. The lineup of no-load funds include index, actively managed, ESG (environmental, social, and governance), and Target Retirement Funds.

- Low annual administrative costs (0.45%) and an $750 annual fee cap regardless of account size.

- Easy to open and manage your account(s) 24/7.

- Multiple, convenient options to fund your account(s).