Read articles of interest for district administrators, payroll coordinators, and other district administrative staff.

Articles are available from the past year and are sorted by quarter based on the Benefits NewsBrief email for Wisconsin public school district employers. If you would like to be alerted to timely articles, please sign up at the Benefits NewsBrief subscription page.

October 2023 |

July 2023 |

April 2023 |

October 2023 articles

| >>Adding new accounts to the payroll roster | >>The components of 403(b) plan documents |

| >>Enroll, add, or increase contribution limits! |

Adding new accounts to the payroll roster

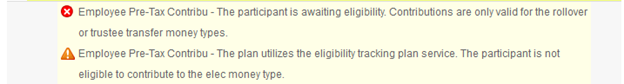

A new 403(b) account needs to go through an overnight validation process before it can be added to the payroll roster. If the new account is added to the payroll roster the same day it was added to the plan, an error message will be displayed.

Error message:

![]()

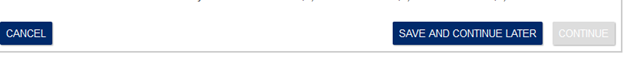

This system will prohibit the roster from being submitted, the “SAVE AND CONTINUE LATER” button will be the only option.

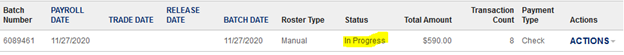

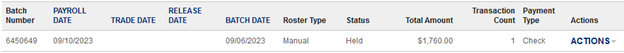

This will put the roster in a “In Progress” status. The next day, the roster will need to be edited, an option that is available under the “ACTIONS” drop-down arrow. The system will allow the roster to process through all necessary screens to move it to a held status for processing.

Contact the WEA Member Benefits Plan Administration team at 1-800-279-4030 or email them at WEAPlanAdmin@weabenefits.com with any questions.

The components of 403(b) plan documents

Employers offering the 403(b) were required to adopt a written plan document for plan years beginning after December 31, 2008. The plan must comply with the 403(b) code and regulations. The 403(b) plan documents have a few basic components.

Plan document

The overall encompassing document that outlines the IRS pre-approved plan language. Provides definitions of terms used and describes the plan’s permissible features under Section 403(b).

Adoption Agreement

The document that allows employers to select the provisions that they will include in their 403(b) plan. The employer signature in this document officially states that they have “adopted” a 403(b) plan.

415 Notice

A calendar year notice is available from your document provider every January and needs to be delivered to employees each year. The notice defines the aggregation of maximum contribution limit with 401(k), 403(b) and SEP retirement plans. The notice states the contribution year limit for employer and employee contributions within these retirement plans. The employee has the responsibility of informing their employer if they are making contributions to another retirement account to avoid a 415 excess. If an excess occurs, the correction must be processed from the 403(b) account.

Please note that contributions to the 403(b) and the 457 accounts are not aggregated. They have separate contribution limits.

Universal Availability Notice (UAN)

Like the 415 notice, this is provided by your document provider every January and needs to be delivered to employees each year. The notice informs your employees that a 403(b) is offered and their right to participate.

Annual Notice

A notice that must be provided to all employees of an automatic enrollment district annually by December 1. The notice outlines the employees that are automatically enrolled and the default contribution amount.

Service Provider Agreement (SPA)

The service provider agreement outlines terms and conditions between the employer and service provider (vendor). It is important to review these documents, as there are many variances in service provider agreements. They can range from a joint responsibility between employer and vendor to a vendor simply being a receptacle for 403(b) monies.

Contact the WEA Member Benefits Plan Administration team at 1-800-279-4030 or email them at WEAPlanAdmin@weabenefits.com with any questions.

Enroll, add or increase contribution limits!

The end of the year is a great opportunity to remind employees to enroll, add, or increase their contributions to retirement accounts. If an employee isn’t enrolled, it’s never too late to start. If employees are enrolled but not maximizing their contributions, they may wish to re-evaluate the amount that they are putting toward retirement. Not only do contributions receive favorable tax treatment, increasing contributions over time helps ensure you’re doing all you can to pursue your financial goals.

Employees can learn more about opening an account or increasing their contributions by visiting us online here: https://www.weabenefits.com/retirement/.

July 2023 articles

Mutual Fund Change in July

A mutual fund change is coming in July. There will be a blackout period from July 24 to July 27, 2023. During this time, distributions, loans, exchanges, rebalances, and updates to future investment elections will be held for processing until after the fund changes. All of the other details can be found in a recent mutual fund change email. View a copy of the mutual fund change email here.

403(b) Automatic Enrollment Reminder

As one school year ends, another begins and with it comes the hiring of new employees. For districts using automatic. 403(b) enrollment, this means that the new hires need to be added to the 403(b) plan. An email will be sent to automatic enrollment Plan Sponsors that use WEA Member Benefits plan documents. The email will provide the Plan Sponsor with a copy of the automatic enrollment annual notice, which needs to be provided to all new employees. The email will be coming in late July or early August. Contact the WEA Member Benefits Plan Administration team at 1-800-279-4030, Extension 8579, or email them at WEAPlanAdmin@weabenefits.com with any questions.

Employment Status Updates and Plan Sponsor Access

Employment Status Updates

The end of the school year brings about employee changes. If your district has experienced employee retirements or terminations, it is important to relay this information to WEA Member Benefits each year. Updated employment status allows for processing of employee requests such as distributions and rollovers that require a qualifying event.

In addition, if your district offers an Employer contribution with a vesting schedule, it is important that unvested funds are removed from terminated/retired employees. It is good to get into the habit of updating separation of employment information on an annual basis in yourPlan Access system.

Employment status is located under “Participant Information.” Please call 1-800-279-4030, Extension 8579, to have the Plan Administration Team walk you through the online process.

Plan Sponsor Access – yourPLAN ACCESS™

The administrative office is not spared from employment changes. It is important to make sure that only active office personnel have access to the district’s 403(b) plan sponsor portal. In addition, it is important to make sure that authorized office personnel are only using the access that is assigned to them. If your district has experienced a change of employment in the business office, please make sure to contact us to remove the former employee and set up new access for the active employee. Contact the WEA Member Benefits Plan Administration team at 1-800-279-4030, Extension 8579, or email them at WEAPlanAdmin@weabenefits.com with any questions.

Introducing Brad Brinkmeier, Senior Retirement Enrollment Consultant

Brad Brinkmeier has been with WEA Member Benefits for seven years. During those seven years, his role as a Retirement and Investment Services Specialist provided him with opportunities to assist with new account enrollments. Brad is a registered representative and an outstanding resource for any employee who would like to ask questions and/or get assistance with enrollment. Brad can assist your staff with retirement account enrollments, answer questions about investments, and rollover outside accounts. Please provide his link to employees that are looking to set up the 403(b) or an IRA. Link: https://calendly.com/bbrinkmeier/403b-ira-phone-consultation.

SECURE 2.0 Update

The WEA Member Benefits Plan Administration team continues to evaluate SECURE 2.0. We will be providing additional education on the provisions as more IRS guidance is provided. A plan review with your Worksite Benefit Consultant (WBC) will be part of that education. Contact the WEA Member Benefits Plan Administration team at 1-800-279-4030, Extension 8579, or email them at WEAPlanAdmin@weabenefits.com with any questions.

Employee Financial Wellness Starts with the Employer and Benefits Everyone

Engagement in workplace retirement plans is fundamental to employees’ retirement readiness. When saving for the future, how prepared are your employees?

Member Benefits can help you explore the role school districts have in preparing their employees for retirement. Here are some of the topics we can help you address.

- Why having financially healthy employees saves school districts money.

- Why your employees aren’t saving and what you need to know to help them become financially healthy.

- The importance of financially healthy employees and the need for workplace financial wellness programs.

- A checklist every 403(b) plan should have.

- Future trends in school district 403(b) plans.

- Effective ways to encourage retirement savings at no additional cost to the district.

Your district’s WBC is here to assist you with your financial education plan. If you are unsure of your WBC’s contact information, contact the WEA Member Benefits Plan Administration team at 1-800-279-4030, Extension 8579, or email them at WEAPlanAdmin@weabenefits.com and they can provide you with that information.

April 2023 articles

Qualified Birth and Adoption Distributions (QBAD)

Qualified Birth and Adoption Distributions (QBAD) became an optional in-service withdrawal under a 403(b) with the passing of The Setting Every Community Up for Retirement Enhancement (SECURE) Act that was passed in December 2019 and became law as of January 1, 2020. QBAD withdrawals are an optional provision that can be added to your 403(b) plan. If we are your document provider, the QBADs were part of the 2022 amendment process that was discussed with your Worksite Benefit Consultant.

A QBAD gives participants in an eligible 403(b) plan the opportunity for an in-service withdrawal anytime during the one-year period after the birth or legal adoption of a child. The SECURE Act defined QBADs as (1) not subject to the 10% early withdrawal penalty, (2) not treated as an eligible rollover distribution, (3) limited to $5,000 per qualifying event, and (4) repayments that can be made to a qualified retirement plan or an IRA.

The SECURE Act provisions left plan sponsors with more questions than answers. On September 2, 2020, the IRS issued Notice 2020-68, which provided the guidance for implementing QBADs. Notice 2020-68 provided the following clarification:

- Defined “eligible adoptee” as an individual who has not yet attained age 18 or is physically or mentally incapable of self-support. They further clarified that an “eligible adoptee” cannot be the child of the taxpayer’s spouse.

- A QBAD of up to $5,000 may be taken by each parent for the same child.

- The birth of multiple children or adoption of multiple eligible adoptees allows the individual to take a QBAD of up to $5,000 for each eligible child. If the birth or adoption was twins, the individual would be able to take a QBAD of up to $10,000.

- QBADs are discretionary. The plan sponsor is not required to add the option to their 403(b) plan. However, if it is allowed, the plan must allow for rollover contributions. The plan must allow the individual to repay the QBAD back into the plan.

- The individual requesting the QBAD can self-certify that they qualify unless the plan sponsor has actual knowledge to the contrary.

- An individual that takes a QBAD must provide the name, age, and taxpayer identification number of the child on their income tax returns for the year in which the distribution was made.

SECURE 2.0 became law on December 29, 2022, and cleared up the repayment of QBADs. Prior to SECURE 2.0, there was no time limit on the repayment of the QBAD. The enactment date of December 29, 2022, changed the repayment time limit to 3 years.

Is employment status information up to date for your employees?

Separation from service is one of the IRS qualifying events that allows employees access to their funds. It is important to have updated employment status information in the online system to aid in determining if a withdrawal or rollover is an option.

Updating employment status is quick and easy through the yourPLAN ACCESS™ portal. If you are not already updating employee information through yourPLAN ACCESS, we encourage you to contact Plan Administration at 1-800-279-4030, Extension 8579, or email at WEAPlanAdmin@weabenefits.com. We know that you will find this to be a convenient and easy way to make employee updates.

IRS 2022-2023 Priority Guidance Plan

The Priority Guidance Plan is a joint effort between the Department of the Treasury and the Internal Revenue Service to outline their focus for a 12-month period from July 1, 2022, through June 30, 2023. The full Priority Guidance Plan has 205 projects and will be updated throughout the plan year to allow for flexibility for new legislative developments. The second quarter update was released on February 21, 2023. The update reflects 101 items that were either completed or in process by December 31, 2022. There were 6 additional projects added in the February update. There are several Secure 2.0 items on the list, which will provide the additional guidance that is required to implement. Here are items that relate to the governmental 403(b):

- Regulations under 72(t) relating to the 10% additional tax on early distributions.

- Regulations relating to the timing of the use or allocation of forfeitures in qualified retirement plans.

- Regulations updating electronic delivery rules and other guidance for providing applicable notices and making participant elections.

- Guidance on student loan payments and qualified retirement plans and 403(b) plans.

- Guidance on missing participants, including guidance on uncashed checks.

WEA Member Benefits will continue to monitor and provide updates. Contact the WEA Member Benefits Plan Administration team at 1-800-279-4030, Extension 8579, or email them at WEAPlanAdmin@weabenefits.com with any questions.

SECURE 2.0 decisions need to be made

SECURE 2.0 became law on December 29, 2022; however, it is still a very fluid situation. There are a lot of questions that require further guidance from the IRS. One certainty is that another round of plan document amendments is needed. There are several optional provisions that plan sponsors should start looking at to determine if they will be added to plan documents. If WEA Member Benefits provides your plan documents, your Worksite Benefit Consultant (WBC) will review these in more detail during a 403(b) plan review. The optional items to start considering are:

- Emergency savings accounts provide employees an opportunity to save toward an emergency savings account linked to their employer plan (optional). These accounts are capped at $2,500, and the contributions are made on a Roth-like basis. The contributions are treated as elective deferrals and are included in matching contributions. Distributions are deemed to be qualified Roth distributions and are not taxable. A participant can take a distribution at least monthly, and the first four distributions may not be subject to any fees or charges. Any subsequent distributions may be charged reasonable fees. At separation of service, the emergency savings account can be rolled to a Roth source (if plan allows), rolled to a Roth IRA, or cashed out to the employee. This is available January 1, 2024.

- Emergency Distributions are a new hardship distribution of $1,000 per year (optional). However, the account owner is not eligible for another emergency distribution until the earlier of; 3 years or when the distribution amount is recontributed to a plan.

- Increase the mandatory distribution limit from $5,000 to $7,000. An employer may transfer former employee accounts from their retirement plan to an IRA if the balance is between $1,000 and $7,000 (optional). This is available January 1, 2024.

- Domestic abuse penalty-free distributions may be permitted in the amount of the lesser of $10,000 or 50% of the presently vested account balance (optional). The distribution can be self-certified and is available up to one year after the date the individual became a victim of domestic abuse. The distribution can be repaid within three years. This is effective after December 31, 2023.

- Student loan payments are treated as elective deferrals for purposes of matching contributions (optional). This will permit employers to make matching contributions to an employee’s 403(b) account based on the employee’s qualified student loan payments. An annual self-certification by the employee is required. This is available January 1, 2024.

- Hardship withdrawals can be taken from elective deferrals, qualified nonelective contributions, qualified matching contributions and earnings from all before mentioned contribution sources (optional). This is available for plan years beginning January 1, 2024.

- Safe harbor correction for elective deferral failures involving automatic enrollment or escalation is made permanent. If a correction is made within 9½ months after the end of the year of the failure (or sooner if notified by employee), a missed deferral does not have to be made (optional). This applies to a failure to implement a feature of automatic enrollment or a failure to offer an eligible employee an election. Treasury needs to provide more details on the regulations. As stated, the employee should be provided with a notice acknowledging the error and a QNEC made for any missed matched contributions.

Also, one of the mandatory provisions needs to be reviewed. In 2024, a plan that offers catch-up contributions needs to have the 403(b) Roth deferral source to continue to offer these contributions.

- Catch-up contributions are to be made in the form of Roth contributions. If a 403(b) plan allows catch-up contributions, those contributions must be made on an after-tax (Roth) basis. This means that a plan allowing catch-up contributions must also allow Roth contributions. An exception is made for employees with compensation of $145,000 or less (indexed). This is available January 1, 2024. This is mandatory, but if your plan does not offer Roth, it needs to be added to the plan to continue with catch-up contributions.

The items outlined above will be available January 1, 2024. WEA Member Benefits will be providing additional education on the provisions. A plan review with your WBC will be part of that education. This article is to start the thought process on what items fit with the goals for your district’s 403(b) plan. Contact the WEA Member Benefits Plan Administration team at 1-800‑279‑4030, Extension 8579, or email them at WEAPlanAdmin@weabenefits.com with any questions.

I suggest standardizing either “effective after December 31” or “available January 1” throughout the document.

Automatic Enrollment and Auto Escalation

Automatic enrollment and auto escalation are great tools and a proactive way to encourage employees to save for retirement. Inertia is a common barrier to employees starting to save—automatic enrollment and auto escalation uses inertia to benefit the employee by switching the required action to opting out rather than requiring each employee to complete a 403(b) enrollment. The plan sponsor (school district) sets a default deferral amount and enrolls employees into the 403(b). The employee receives notice of enrollment and can opt out of the default deferral amount by entering zero, a different percentage, or flat dollar amount. A change from the defaulted pre-tax source to the Roth deferral is also an option for the employee.

Auto escalation is an added feature to the automatic enrollment benefit. Auto escalation automatically increases an employee’s 403(b) deferral rate at set intervals until reaching a predetermined maximum contribution rate selected by the employer. Like automatic enrollment, auto escalation uses inertia to benefit employees by overcoming the procrastination that commonly occurs with increasing contributions over time. The plan sponsor indicates the rate of increase (ex. 1%) and sets the maximum percentage (ex. 10%). In this example, the default deferral rate will increase 1% annually and will stop when the default deferral reaches 10%.

Automatic enrollment and auto escalation is part of SECURE 2.0 and will be mandatory for new ERISA 403(b) plans established in 2024. Existing plans are grandfathered. This does not apply to non-ERISA (governmental) 403(b) plans that are provided by public school districts. Although not required for your 403(b) plan, the addition of this benefit to SECURE 2.0 highlights the value of this option.

Hooray for summer (it is coming)!

There are a couple things that summer brings around that are not so exciting. These are construction and audit season. We have no relief for orange cones, but we can help with audits. The online system of yourPLAN ACCESS has a tab for reports which provides a great array of data for your audit.

The system can provide you with a list of employees that have 403(b) accounts in your plan. There are reports to display general census information, current contributions, employee balance information, or recent withdrawals. The reports available should aid in your audit needs. Please check out the options available in yourPLAN ACCESS under the “Reports” tab. If you have any questions or would like a tutorial, contact the WEA Member Benefits Plan Administration team at 1-800-279-4030, Extension 8579, or email them at WEAPlanAdmin@weabenefits.com with any questions.

Created by educators

WEA Member Benefits

Over 50 years ago, we were created by Wisconsin educators for Wisconsin educators. No other financial organization can say this. Explore our unique programs and services.